Measure the performance of your sales force and marketing channels, adapt your commercial strategy and gain real world competitive insights.

Introduction

The true impact of each promotional channel has long been an enigma to the life sciences industry. As customer behaviours and preferences evolve, it is becoming ever more challenging to determine the optimal combination of promotional channels. The COVID-19 pandemic instigated a rise in digital channels such as emails and video calls, causing a shift in the promotional landscape that life sciences companies must now navigate. The pandemic has also left healthcare systems stretched, resulting in healthcare professionals (HCPs) having less time to engage with the promotional efforts of life sciences companies.

Alongside this, other changes in the market are adding to the complexity of channel mix. As HCPs become increasingly digitally astute, their preferences are evolving, and this trend is accelerated by younger HCPs gradually replacing the older generation as they retire. The rapid rise of digital tools and Artificial Intelligence (AI) also affects life sciences companies directly: with the new opportunities to optimise promotion come challenges around understanding and implementation. The combination of these factors heightens the need to select the best promotional channels. However, HCPs currently report poor alignment between their preferred channels and the promotion they receive in reality,[i] revealing significant room for improvement.

How can the impact of promotion be estimated?

This two-part blog series explores insights developed using IQVIA’s econometric, AI-based Promo Mix model. Specifically, the model combines promotional spend by channel with product-level sales data, to estimate the relative contribution from each channel. The outputs have been aggregated for over four thousand products across the EU4&UK, outlining how the effectiveness of promotion has evolved since the start of the COVID-19 pandemic – the focus of Part I. The second blog comprises comparisons across countries and therapy areas, followed by an analysis of promotional return on investment (ROI) by product to highlight differences at a more granular level.

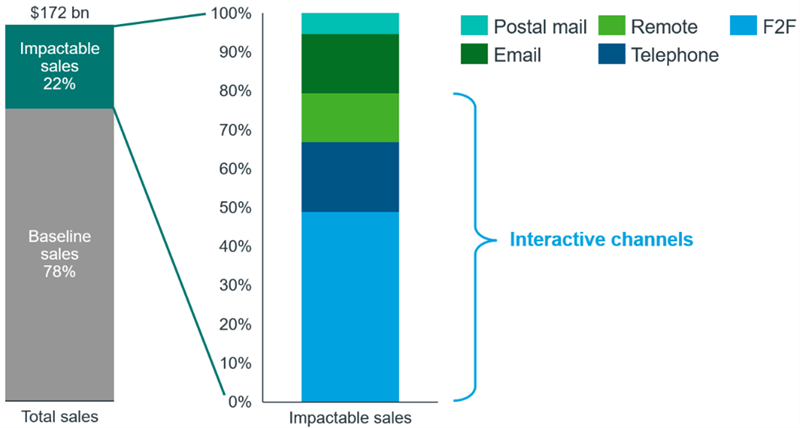

To assess the effect of promotion, sales for each product are split into impactable sales and baseline sales. Impactable sales result directly from promotional activity, whereas baseline sales are generated by brand equity and carryover (i.e., the cumulative effect of previous promotional activity) as well as external factors, such as seasonal variation. Figure 1 depicts the evolution of impactable and baseline sales in the EU4&UK for Product X – a product which was approved by the European Medicines Agency in 2015. When Product X was relatively new to the market, almost all sales were impactable, which reflects the importance of updating HCPs with the latest information about new treatment options. As Product X became more established in the market, baseline sales accounted for an increasing proportion of all sales; by this time, many HCPs were already aware of the product and prescribing it routinely.

Figure 1: Evolution of impactable and baseline sales for Product X in the EU4&UK

Source: IQVIA Promo Impact model, Q2 2016 to Q1 2023, with data provided from IQVIA ChannelDynamics and IQVIA MIDAS.

How is the promotional landscape evolving?

Analysis of sales for over four thousand products shows that, on average, impactable sales constitute 22% of total sales in the EU4&UK (MAT Q1 2023) across launch, growth and mature products. Figure 2 illustrates the breakdown by channel of these impactable sales: half are attributed to 1:1 face-to-face (F2F) interactions, while 1:1 telephone calls account for the next largest share, at 18%. These are followed by contributions from emails, 1:1 remote video calls (hereafter referred to as remote interactions) and postal mailings.

Figure 2: Aggregated EU4&UK sales (MAT Q1 2023), with impactable sales split by channel

Source: IQVIA Promo Impact model, with data provided from IQVIA ChannelDynamics and IQVIA MIDAS for over four thousand products. COVID-19 products are excluded from the analysis.

Together, the highly interactive channels (1:1 F2F, telephone and remote interactions) account for almost 80% of impactable sales. These channels enable sales representatives to build rapport with HCPs, answer questions, and energise the interactive experience. However, the time available to interact with HCPs remains lower than pre-COVID-19[ii], meaning that each interactive opportunity is now more valuable. During the COVID-19 pandemic, there was a significant increase in the number of emails sent to HCPs, but Figure 2 strongly suggests that emails alone cannot match the impact of highly interactive channels. This also indicates that the quality of the interaction is more important than the volume, with excessive email traffic likely to be off-putting for HCPs.

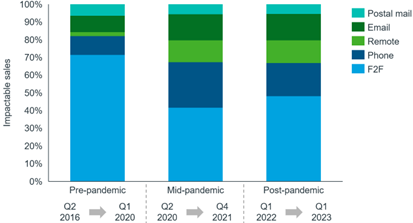

The COVID-19 pandemic undoubtably caused a shift in the promotional landscape, as seen in Figure 3. Most notably, F2F contributions to impactable sales have dropped from 71% pre-pandemic to 48% post-pandemic, while the rise of digital channels, such as remote video calls, has accelerated. Multiple channels now account for a substantial share of impactable sales, and the lack of significant movement towards the pre-pandemic balance suggests that digital channels have become firmly established.

Figure 3: Evolution of impactable sales by channel in the EU4&UK

Source: IQVIA Promo Impact model, with data provided from IQVIA ChannelDynamics and IQVIA MIDAS. Each time period is defined as follows: pre-pandemic is Q2 2016 to Q1 2020; mid-pandemic is Q2 2020 to Q4 2021; post-pandemic is Q1 2022 to Q1 2023.

To better understand Figure 3, two underlying components must be unpicked. For any channel, evolution of impactable sales is due to the combination of

- a change in spending on promotion and

- a change in promotional ROI for that channel (due to many factors, such as evolving channel affinity).

Promotional ROI is defined as the ratio of impactable sales to spend on promotion, and therefore provides a measure of success for a given channel. The two factors above can be investigated for F2F engagement. IQVIA ChannelDynamics data shows that total spending on F2F promotion has dropped substantially from pre-pandemic to post-pandemic. However, ROI for F2F engagement is now 20% greater than pre-pandemic. This is significant: despite F2F interactions being less common than before, they now have greater promotional ROI.

Therefore, F2F promotion remains crucial: it is being enhanced by other channels, rather than replaced. The impacts of the different channels are interdependent, and each engagement with promotion forms part of a journey for each individual physician. In addition to the combination of channels, the sequence and function of interactions are key to driving impact.

In summary, the highly interactive channels continue to dominate impactable sales post-pandemic, albeit in different proportions. Far from being replaced, F2F interactions play a key role in the customer journey, and are increasingly being complemented by other channels in order to achieve maximum impact.

The second part of this analysis will focus on how the post-pandemic promotional landscape differs by country and by therapy area in the EU4&UK.

Enjoyed this topic? Listen to our authors engage in an in-depth discussion in this on-demand webinar.

References

[i] IQVIA 2023 ChannelDynamics™ Channel Preference Survey https://www.iqvia.com/blogs/2023/10/choosing-the-right-channel

[ii] Launch Excellence VIII - IQVIA

Read part two here.

Related solutions

Maximize the value of your brand with personalized, precise, and efficient communications.