Gain high value access and increase the profitability of your brands

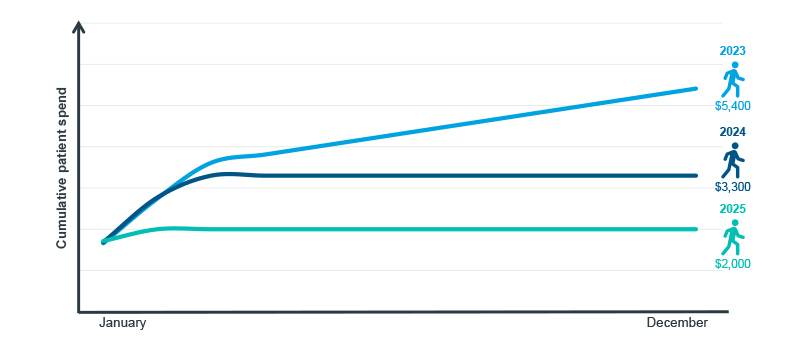

There are a few provisions of the Inflation Reduction Act (IRA) of 2022 that will have a direct impact on patient costs, and they have already taken effect. In 2023, patient costs for vaccines and insulins were capped at $0 and $35, respectively. In 2024, patient cost-sharing during the Catastrophic phase of coverage was also reduced from a 5% coinsurance to $0, resulting in an effective cap on patient spending in Standard Medicare Part D plans. This new cap has already begun to increase utilization of specialty medications. The cap will lower to $2,000 in 2025, coinciding with the sunsetting of the Medicare Part D coverage gap altogether. Understanding how the 2024 provisions have already shifted patient costs and behaviors is an important preview for how further changes in 2025 will transform the patient experience.

A direct impact on lowering costs

Prior to 2024, Standard Eligible patients were required to pay a 5% coinsurance in the Catastrophic phase of coverage. This meant paying out of pocket every month through the end of the year and led to high, annual expenses. The removal of Catastrophic coinsurance in 2024 put an approximately $3,300 limit on how much Part D patients would spend on pharmaceuticals. The $2,000 out-of-pocket cap in 2025 will benefit enrollees even more.

Example of cumulative patient spend in Medicare Part D with $4,000 monthly costs

Note: Standard Eligible Patients; based off of actuarial average benefit design without supplemental coverage.

Source: U.S. Market Access Strategy Consulting analysis

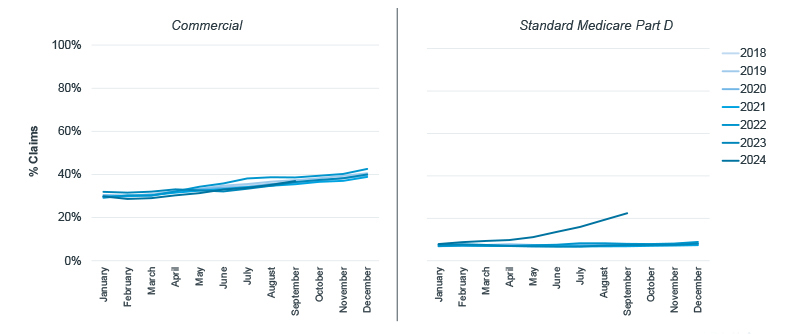

For both Commercial and Medicare patients, $0 claims have always existed, either due to out-of-pocket limits in private insurance or caps in out-of-pocket for certain Medicare groups. As patients increasingly accrued costs later in the year and hit out-of-pocket caps, the proportion of $0 claims rose. However, $0 Catastrophic patient costs in 2024 resulted in a new trend unique to Standard Medicare patients. Across all Medicare patients, the proportion of $0 claims began to rise sharply in May – to 11%, up from 7% in the three preceding years. The $0 coinsurance for patients in Catastrophic coverage meant that average cost exposure dropped from $73 in September 2023 to $64 in 2024. Cost trends among Commercial claims are consistent year-to-year as the benefit change is unique to Standard Medicare.

Proportion of claims with $0 patient cost by payer channel

Note: $0 claims are identified as having cost exposures (before co-pay support/buydown) equivalent to $0; Brands only; Vaccines excluded.

Source: IQVIA LAAD 3.0 Data; U.S. Market Access Strategy Consulting

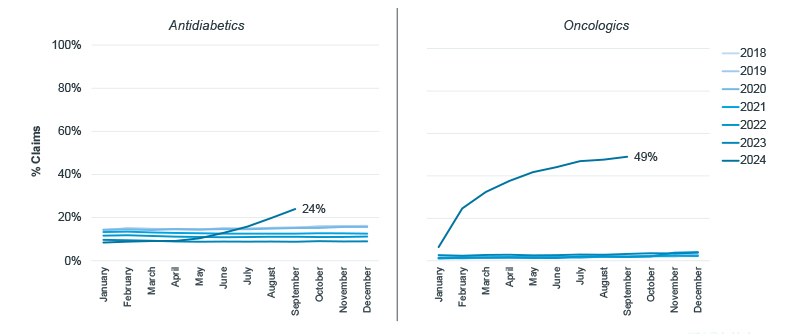

Part D patients move through phases of coverage based on cumulative spending. Because specialty medicines cost more than traditional ones, patients with high-cost treatments for conditions like cancer tend to reach the Catastrophic phase more quickly than others. Though out-of-pocket spend was capped in 2024, patients on antidiabetic drugs did not start to hit the cap until May; by September the average cost per prescription was 9% lower than the year before. Claims for oncologics, however, were immediately impacted, as 25% of patients hit the out-of-pocket limit and entered Catastrophic coverage already by February. By September 2024, half of all branded oncology prescriptions were $0, and the average cost per prescription was 69% lower than the previous September.

Proportion of claims with $0 patient cost in Standard Medicare by market

Note: $0 claims are identified as having cost exposures (before co-pay support/buydown) equivalent to $0; Brands only.

Source: IQVIA LAAD 3.0 Data; U.S. Market Access Strategy Consulting

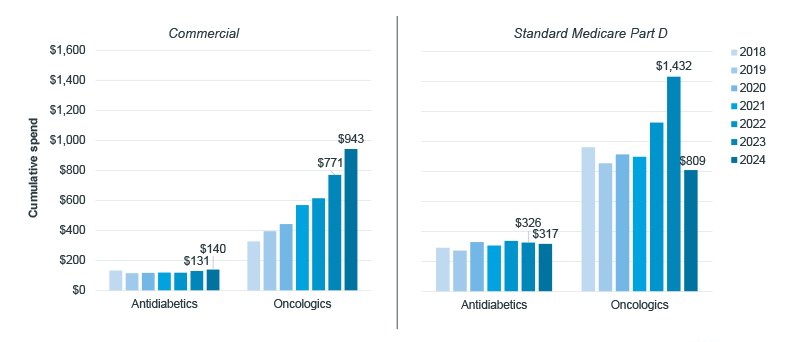

Impact on patient spend and patient behavior

The implementation of $0 coinsurance in the Catastrophic phase of coverage restricted annual patient out-of-pocket spend where there previously was no limit. Prior to 2024, Medicare patients in the Catastrophic phase would have paid a 5% coinsurance on every prescription through the end of the year. As a consequence of this, Standard Medicare patients spent a cumulative $1,432 on their first six months of cancer treatment in 2023. After the 2024 changes went into effect, Medicare patients only spent $809 in the first six months of treatment, a reduction of 44%. For a less expensive market like antidiabetics, six-month cumulative spend remained relatively consistent, as patients were not hitting the Catastrophic phase as readily. Just as cost exposure trends for Commercial patients did not change in 2024, cumulative costs across markets continued to trend upward as they had done year-over-year.

Six-month cumulative spending trend by market and payer channel

Note: Six months from a new start in January, February, or March; Brands only.

Source: IQVIA LAAD 3.0 Data; U.S. Market Access Strategy Consulting

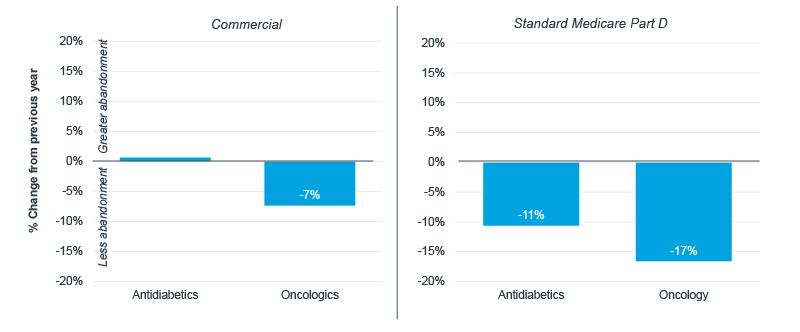

The effective cap on Medicare patient spending resulted in fewer abandoned prescriptions. In 2024, abandonment rates decreased relative to 2023 for both antidiabetics and oncology drugs. For Commercial oncology, this reduction was driven by a 21% increase in the use of copay cards and other assistance programs. In contrast, copay assistance for antidiabetics actually declined by 6% over the same period. In Medicare, the decline in abandonment was even more pronounced. For antidiabetics, the $35 insulin cap introduced in 2023 continued to reduce abandonment into 2024. However, the Medicare out-of-pocket cap in 2024 played an even larger role in oncology, where abandonment for new patient starts dropped by 17%, resulting in a significant improvement in therapy initiation.

Change in new patient abandonment from 2023 to 2024 by market and payer channel

Note: Abandonment defined as claims that were not filled within 14 days of approval; January through September abandonment; Brands only.

Source: IQVIA LAAD 3.0 Data; U.S. Market Access Strategy Consulting

Great expectations for 2025

Approximately one-third of adults have reported not taking or filling their medications as prescribed because of concerns around cost. Medicare patients are especially at risk as they tend to face serious health conditions requiring costly medications and are often living off fixed incomes. Through different provisions, the IRA has attempted to address this issue. Between vaccine and insulin out-of-pocket caps, limits on how much insurance companies can raise premiums, and the redesign of Medicare Part D, the Centers for Medicare and Medicaid Services has attempted to help Medicare patients better afford their medications on a daily basis. Though time will tell what kind of impact these other provisions will have, there is no doubt that the changes already made to the benefit design are achieving their intended goal.

The differential impact that the $3,300 cap had on specialty markets versus traditional markets may narrow in 2025 once the cap is reduced to $2,000. The lower threshold allows patients across markets to reach Catastrophic coverage more quickly and face more $0 claims. This will directly impact patients, bringing down costs regardless of other forces – such as price/rebate dynamics – occurring in the healthcare ecosystem. Lower costs have already begun to increase utilization of high-cost drugs, so undoubtedly there will be downstream impacts on patient access as payers attempt to curb increased spend. The benefit design changes in 2024 have already begun to lighten the financial burden of costly medications, improving the initiation of therapy. As the out-of-pocket cap decreases even further in 2025, additional benefits will be both expected and welcome.

IQVIA’S Market Access Center of Excellence

In a time when better access has never mattered more, IQVIA has built the largest and most experienced market access team in the industry. That team of experts drives IQVIA’s Market Access Center of Excellence, powered by intelligent connections between data, analytics, technology, and strategy to help clients navigate today’s challenging access environment.