- The IRA’s MFP applicability begins at 9 years for small molecules, 4 years earlier than biologics.

- For small molecule products launched from 2005 to 2009, this 4-year difference accounts for a third of average sales revenues over the first 13 years.

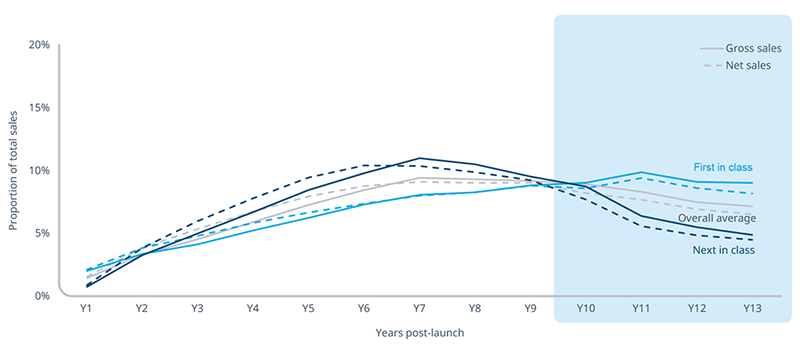

- Lifetime sales revenues are even more backloaded for first-in-class medicines.

- The substantial reduction in expected revenues resulting from the IRA’s MFP applicability at 9 years disincentivizes investment in small molecule drug development.

The Inflation Reduction Act’s (IRA) Medicare Drug Price Negotiation Program grants authority for Medicare to set a Maximum Fair Price (MFP) on top-spend brands. Drug eligibility for the Program is dependent upon multiple aspects, including time on the market. Small molecule medicines with 7 years and large molecules (biologics) with 11 years after FDA licensing can be selected for MFP, meaning they can have as few as 9 and 13 years, respectively, on the market before MFP applicability.

When the IRA was signed into law in 2023, opponents cautioned that the Program would negatively impact drug development, in addition to triggering other, more immediate effects on patient access and choice. In order to shed more light on the extent to which the IRA’s Medicare Drug Price Negotiation Program reduces incentives for small molecule drug development, the analyses below quantify the lifetime revenues for small molecule medicines affected by MFP applicability.

Price negotiation eligibility window

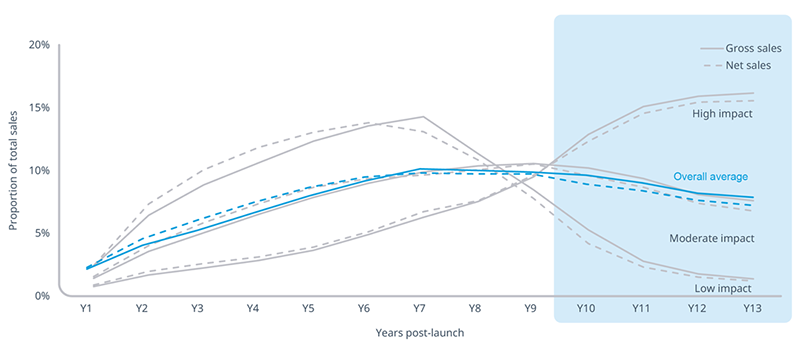

Among 75+ brands that launched between 2005 and 2009, trends in sales revenues (“sales” hereafter) show that post-launch years 10-13 account for approximately one-third of gross and net sales in small molecules. In the context of the Medicare Drug Price Negotiation Program, the timing of MFP not only creates a clear disadvantage for small molecule drug development relative to large molecules, but also affects small molecule brands at a time of peak revenue generation.

The Price Negotiation Program reduces net sales in a few ways. Set discounts have a direct impact, ranging from 38-79% for the first 10 selected brands. Moreover, MFP-selected drugs are likely to still face plan sponsor pressure to discount further using rebates, creating an additional indirect impact to sales. Finally, although selected drugs are guaranteed Medicare coverage, plan sponsors can place other brands on more favorable cost-sharing tiers. If the economics of covering higher list price products with larger rebates remain more favorable to plan sponsors, MFP effectively impacts gross sales by driving volume away from the selected drugs.

Annual Proportion of 13-Year Total Sales

Note: Averages portrayed are simple averages, unweighted by brand volume or sales. Total sales reflect the 13-year measurement period.

Source: U.S. Market Access Strategy Consulting analysis, SEC filings, IQVIA Institute Methodology, National Sales Perspective Data (NSP)

Notably, not all drugs follow the same sales trajectories. While 59% of the brands analyzed follow the “Moderate Impact” trajectory that most closely resembles the overall average trend, 19% fall into the “Higher Impact” trajectory where years 10-13 account for 61% of gross sales (59% of net sales). Another 22% fall into the “Lower Impact” trajectory where years 10-13 only account for 11% of gross sales (9% of net sales) -- much lower than the average though still a meaningful amount for manufacturers.

Drug novelty and negotiation impact

Novelty is a key driver behind the different patterns in drug sales. When a drug is first-in-class, it effectively creates a new market, offering a new form of treatment for a particular disease area. Next-in-class therapies, which can offer patients more and even better treatment options, launch later and then face competition earlier in their lifespan from generics of older therapies.

With the Medicare Drug Price Negotiation Program slated to shorten the window of profitability for all selected brands, novel, small molecule brands will experience an even greater proportion of total sales affected by earlier eligibility compared to next-in-class small molecule brands. 40% of gross and 38% net total sales for novel therapies occur between 10 to 13 years after launch. Each figure is 5 percentage points above the average.

Annual Proportion of 13-Year Total Sales by Launch Archetype

Note: Averages portrayed are simple averages, unweighted by brand volume or sales. Total sales reflect the 13-year measurement period.

Source: U.S. Market Access Strategy Consulting analysis, SEC filings, IQVIA Institute Methodology, National Sales Perspective Data (NSP)

Implications for R&D investment

Biopharmaceutical companies face uncertainty when making R&D investment decisions. Most drug candidates that enter clinical trials do not ultimately achieve FDA approval, and FDA approval does not guarantee that a medicine will generate revenues that meet a drug sponsor’s expectations.

The reduction in expected lifetime revenues from MFP creates a disincentive for companies to make the long-term investments required for medicine development. For some drug candidates that would have been forwarded through the development process prior to IRA, companies may no longer pursue investment. While this is true across all medicines, investment in small molecule medicines will be disproportionately affected, because the four-year difference in eligibility for the Program between small and large molecules represents such a large portion of sales.

Post-IRA launch considerations

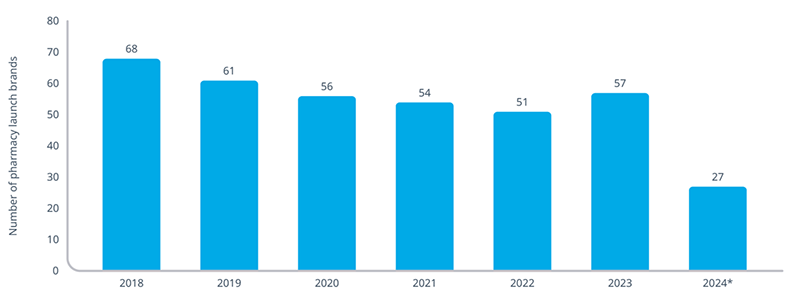

Over the years, launch conditions have grown increasingly challenging between the proliferation of access restrictions and demand for discounts (both in the form of rebates and manufacturer-sponsored copay support). For the most part, launch sales as well as the number of launches have mostly slowed over the last several years. In fact, the 27 pharmacy brands launched in 2024, as of August, are part of a trend of generally declining launch numbers since 2018.

Number of Pharmacy Launch Brands by Year

*2024 launch brands limited to January-August analysis

Note: Launch products above are limited to pharmacy brands and do not include biosimilars, vaccines, or follow-on versions of preexisting brands (i.e., extended release)

Source: IQVIA National Sales Perspective; U.S. Market Access Strategy Consulting

The IRA puts even more pressure on brands to be successful in a shorter amount of time due to MFP dynamics, along with other provisions of the IRA that increase manufacturer liabilities and are expected to restrict access even as patient costs go down. The result: more careful investment in pipelines and drug development. Incentives are reduced both for development of new drugs and for additional development of already-approved drugs. Such ongoing R&D is critical to advancing new indications for approved medicines, including for other diseases and treatment populations, and for expanding treatment options in certain therapeutic areas, such as cancer and other chronic diseases.

Applicability outlook

MFP applicability begins in 2026, affecting 10 brands that have been on the market for an average of 16 years. In the years following, brands selected will have had shorter tenures as the Medicare Drug Price Negotiation Program adds more medicines and expands the number selected. Top-spend brands that appear to meet the timing and spending thresholds for MFP selection in 2027 will have had an average of 12 years in the market. As the window before selection shortens, small molecules will feel that shift most acutely.

This blog and the annual proportion of sales analyses were sponsored by the Pharmaceutical Research and Manufacturers of America (PhRMA). The findings and points of view are the result of IQVIA’s investigation and expertise.

IQVIA’S Market Access Center of Excellence

Related solutions

Gain high value access and increase the profitability of your brands