Rely on market-leading strategists to help you achieve maximum access and profitability

The American Rescue Plan Act (ARPA) removed a cap on the total amount of inflationary rebates (“CPI penalty”) manufacturers are required to pay to Medicaid such that beginning January 2024, manufacturers would take a loss on Medicaid prescriptions wherever penalties and rebates exceed the drug’s Average Manufacturer Price (AMP). Since the announcement of the AMP cap removal, some brands implemented price-cutting strategies. These strategies can be beneficial for the industry by reducing prices while also benefitting manufacturers by reducing their exposure to uncapped CPI (Consumer Price Index) penalties in Medicaid. Yet, what has played out for brands like the asthma medicine Flovent and diabetes drug Humalog was not quite the win-win one might expect, reflecting the complicated and sometimes counterintuitive U.S. managed healthcare system.

Lowering price penalty exposure

Extended patient lives, cumulative price increases, and competitive contracting all contribute to a brand’s exposure to negative margins in Medicaid, but a brand is more able to absorb this liability when Medicaid comprises only a small portion of its total population. Reducing price within the CPI-allowed amount also eliminates exposure.

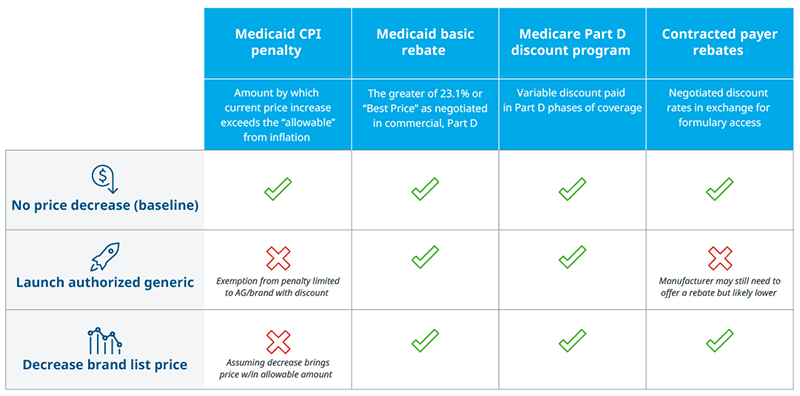

Manufacturers can directly reduce a drug’s price using one of two approaches: launch an authorized generic at a discount from the brand’s list price, and/or reduce the list price on the brand itself. Other dynamics still impact either an authorized generic’s or brand’s margin, including Medicaid’s statutory discounts and the Medicare Part D Discount Program. Avoiding an uncapped CPI penalty, however, ensures margins remain positive for brands affected by the removal. Both approaches enable manufacturers to decrease their prices within a range that does not incur a CPI penalty. Authorized generics historically do not contract for access with payer rebates but may still face pressure to offer rebates depending on the market. If an authorized generic is distributed by a company other than the brand manufacturer, there may also be revenue-sharing agreements in place for sales of the product. Moreover, authorized generics might be priced to avoid a CPI penalty, but if the original brand also remains in-market with a higher price, it would still face penalties.

Note: If an authorized generic (AG) is co-promoted by multiple companies, revenue will be shared between them.

Source: U.S. Market Access Strategy Consulting analysis

Low-cost options, high-priced coverage

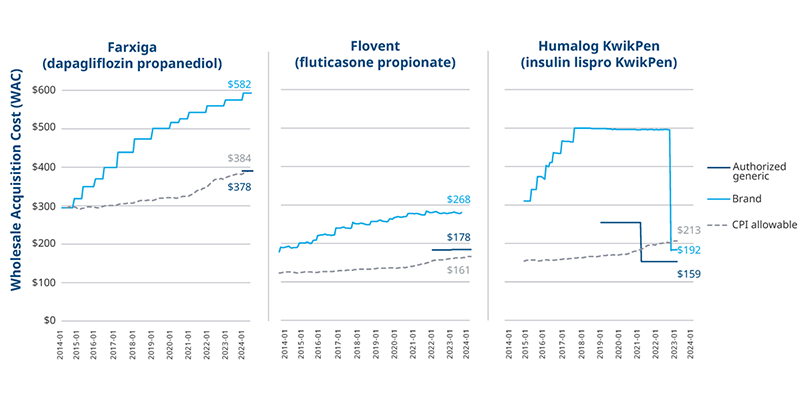

Three brands provide recent examples of price decreases. The diabetes drug Farxiga launched an authorized generic at a 35% discount on the brand while keeping the original brand in the market. Flovent launched an authorized generic and simultaneously discontinued the brand. Humalog launched an authorized generic and decreased the brand Wholesale Acquisition Cost (WAC) four years later. Each brand’s approach to lower prices brought them within range of Medicaid’s “allowable amount,” eliminating exposure to a price increase penalty. However, the system’s complexity means other factors play into the efficacy of any price-cutting strategy.

Price Trends of Brands That Implemented Low-Cost Strategies

Note: Allowable price growth calculated using the CPI-U index by product launch month and WAC; An authorized generic also exists for the vial version of Humalog, but the KwikPen version makes up 65% of Humalog volume; Weighted average WAC across all product NDCs.

Source: Consumer Price Index 1913-2024; MediSpan price data; U.S. Market Access Strategy Consulting analysis

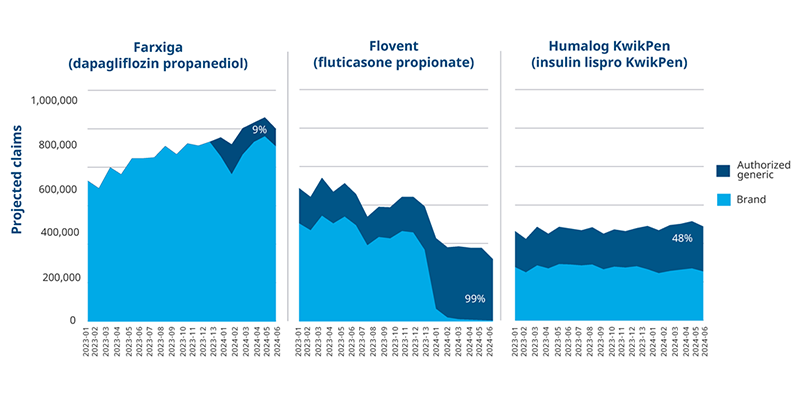

Payers may cover and prefer the original brand over an authorized generic on their formularies. Many factors beyond net cost play into payers’ decisions including rebate dollars, which are greater when drug prices are higher. This can influence the effectiveness of an authorized generic approach to lowering prices (and exposure to penalties) when the higher cost brand stays available in the market and retains its share. For example, seven months after the launch of Farxiga’s authorized generic, the brand retained 90% of the molecule’s volume despite the authorized generic’s discount.

Authorized generics for Flovent and Humalog faced similar access and uptake challenges to Farxiga, but other steps were taken to facilitate low price adoption in both cases. When GSK discontinued branded Flovent, the only option for fluticasone propionate became the authorized generic. Some payers covered the authorized generic, but others did not, disrupting patient access and leading to 50% overall loss in volume for the brand and authorized generic combined in the first half of 2024. In the case of Humalog, slow uptake for the authorized generic was eventually followed by a decrease in the brand’s price, as well. Payer coverage and volume for the molecule remained consistent throughout.

Projected Volume Trend by Molecule, All Payer Channels

Note: An authorized generic also exists for the vial version of Humalog, but the KwikPen version makes up 65% of Humalog volume.

Source: IQVIA PlanTrak Data; U.S. Market Access Strategy Consulting

As other brands mature in the market and liabilities from the Inflation Reduction Act increase, companies may need to explore AMP cap related implications and potential price cutting strategies of their own. In the examples of Farxiga, Flovent, and Humalog, the challenges of cutting price and preserving access are clear. Authorized generics struggle to get the same access as their higher priced counterparts, perhaps putting pressure on the discounted medicines to also contract with rebates. Humalog’s experience is not necessarily a guarantee of success for brands taking their approach, either. Ultimately manufacturers will have to consider the same balance between margin pressures and access that currently drive strategy, assessing price penalty exposure in Medicaid against discounts, rebates, and potential volume loss.

Future strategies in a predictably unpredictable system

Since the announcement of the AMP cap removal in Medicaid, at least 10 high-spend brands introduced low-cost options into the market. While this may be seen as a positive development in terms of drug pricing, complexity in the U.S. healthcare system can result in limited adoption for low-cost alternatives and/or disrupt access.

Policies and market dynamics have a way of resulting in unintended consequences and even counterintuitive results, making it necessary to both model expectations and measure results. As the Inflation Reduction Act (IRA) approaches its most disruptive phases (Part D re-design, Medicare Prescription Payment Plan, and Maximum Fair Price), the removal of AMP cap and resulting price decreases hints at the possible headwinds that discounted drugs are likely to face under price negotiation. Medicare coverage may be required for negotiated brands, but guaranteed access is not necessarily quality or preferential access, leaving space for higher prices to win out in competitive markets much like higher price brands as opposed to discounted, authorized generics.

IQVIA’S Market Access Center of Excellence

In a time when better access has never mattered more, IQVIA has built the largest and most experienced market access team in the industry. That team of experts drives IQVIA’s Market Access Center of Excellence, powered by intelligent connections between data, analytics, technology, and strategy to help clients navigate today’s challenging access environment.