As discussions around healthcare spending escalate, reform is at the center of the policy debate. Under the umbrella of health policy, the U.S. continues to evaluate biosimilars and their potential for curbing drug costs. Most recently, an executive order from the Biden administration1, and a subsequent plan from the Department of Health and Human Services (HHS)2, have considered biosimilars as a tool to increase competition and reduce costs. Yet the questions of what biosimilar success in the U.S. will look like and how policymakers can help achieve that remain unresolved.

In its continued commitment to evidence-based insights, IQVIA brings its analyses of the biosimilar market to the conversation. From a national view to the patient level, these findings are necessary for identifying the opportunities and challenges that biosimilars present.

Defining and measuring success

Often, the industry looks to market share when evaluating product success. Earlier in 2021, The IQVIA Institute reported biosimilars had reached shares ranging from 6% to 42% of volume within their respective molecules3. This range is substantial, but the Institute noted that more recent biosimilar launches are gaining volume more quickly than their predecessors, likely a result of their evolving pricing and market access tactics.

This same report estimated biosimilar savings could reach $140 billion by 2024 as more volume shifts from reference brands to biosimilars. These savings are calculated based on the relative price difference between the reference product and the biosimilar, multiplied by expected uptake of the biosimilar. Yet, savings go beyond differences in pricing. Net cost impact, especially to the reference product, is a critical consideration in the biosimilar discussion.

In a buy-and-bill system, healthcare providers also acquire and seek reimbursement for administered drugs. The discounts made at acquisition are reflected in the Average Sales Price (ASP), which provides a suitable proxy for the net price at which manufacturers sell. The existence of biosimilars can affect reference product ASP as manufacturers must adapt their discounting to remain competitive. In a recent paper4, IQVIA’s Market Access Strategy Consulting practice outlined these dynamics which play a role in biosimilar uptake as well as discounting and system costs.

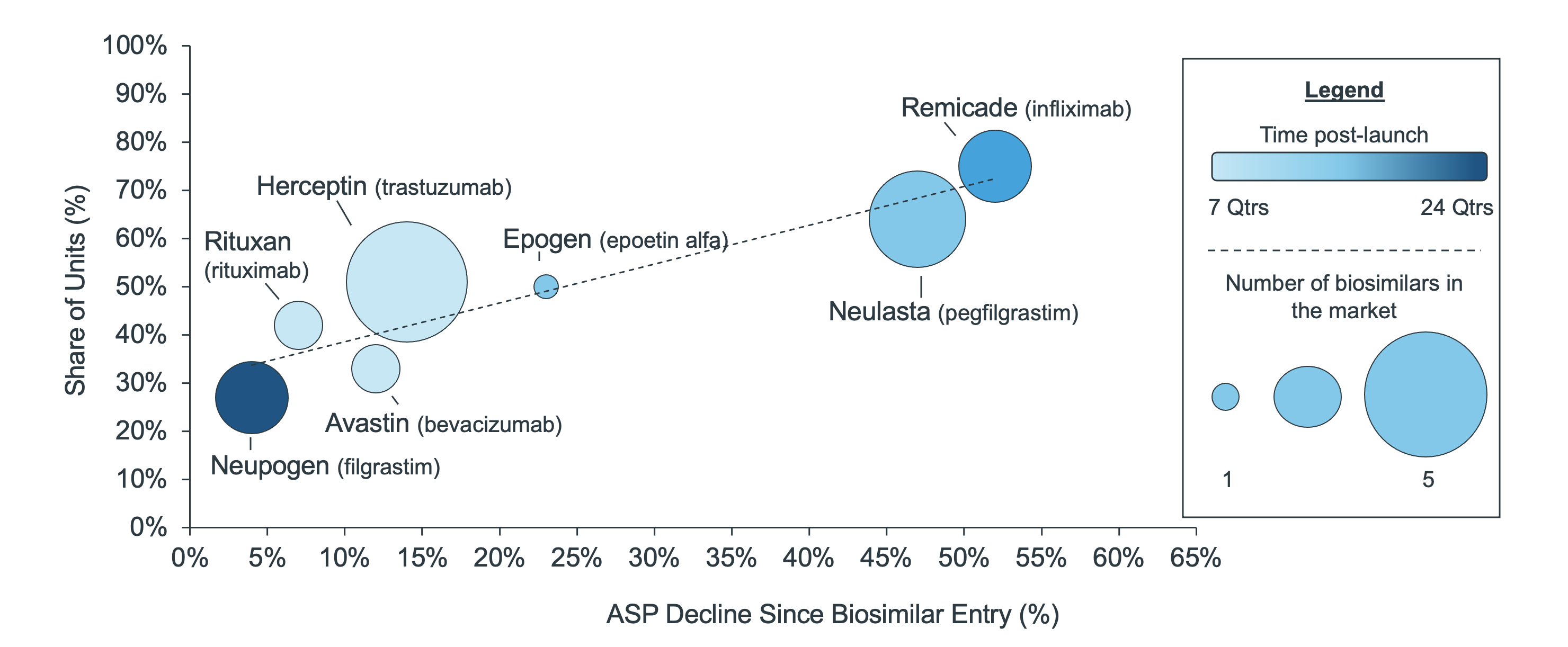

Since launching in the U.S., biosimilars have helped drive reference ASPs down by as little as 4% and as high as 52%. The trend is inversely related to share retention such that reference brands keep more share where they discount heavily and ASP declines (Figure 1). This trend holds regardless of the number of biosimilars available for a given molecule, though with more time there are more opportunities for discounts.

While conventional wisdom might suggest that this means some biosimilar launches have been unsuccessful, this result suggests that even when biosimilars have not gained market share, they have still driven the price of the molecule down. These situations in which a biosimilar launch is unsuccessful for the manufacturer but create savings in the U.S. health care system overall present an interesting situation and lend themselves to more questions – will biosimilar manufacturers continue to enter the market? And who really is saving from these reduced prices?

Figure 1: Innovator share of units and ASP decline since biosimilar launch (Q2-2021)

Reimbursement in Medicare is tied to a product’s ASP. Sometimes reimbursement in the private sector is also ASP-based, meaning that the discounts made by manufacturers are eventually realized in reduced, system-wide costs – though not uniformly as some reimbursement models use wholesale acquisition cost (WAC). Nevertheless, as ASP declines so will unit costs – particularly in CMS-funded Medicare.

Regardless, the definition of biosimilar success may then expand to include any impact to reference ASP, or success could expand further still to cost savings, measured in terms to the average sale amount per unit across all molecule labels and manufacturers. Those savings, combined with biosimilar uptake, more completely account for the complexity of the system.

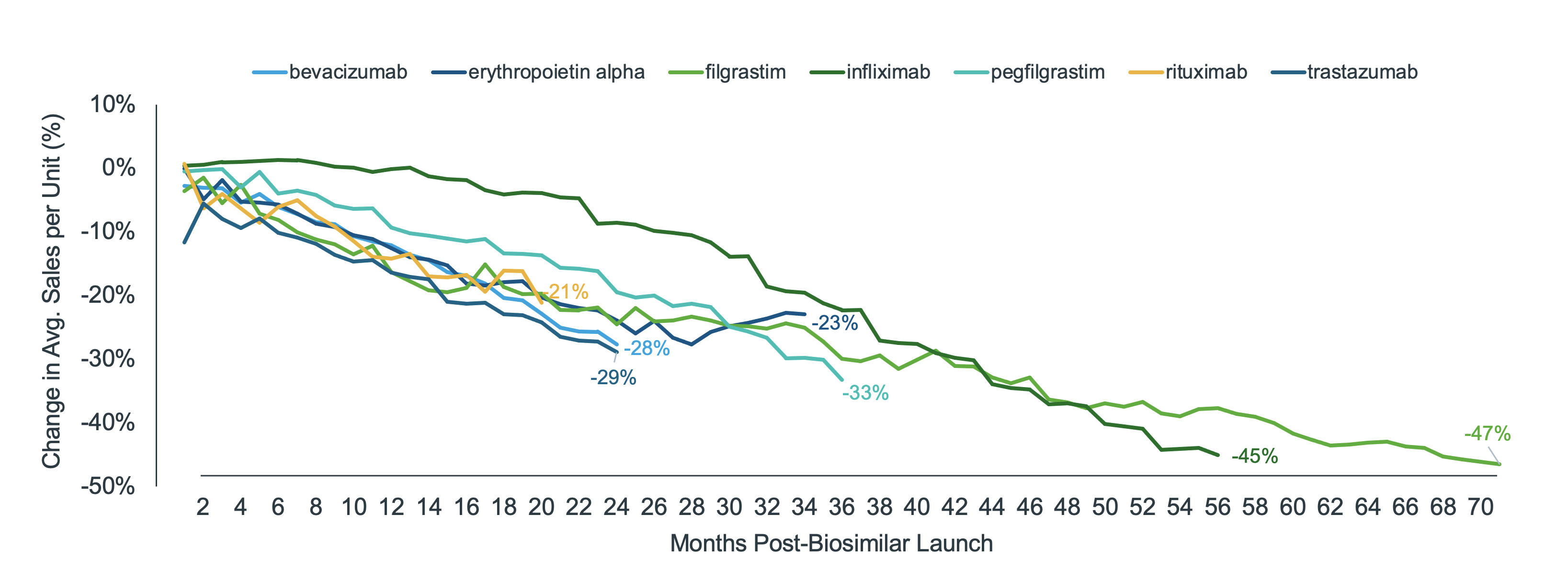

Recent analyses show that by the second year after a biosimilar launch, per unit costs in a given molecule (both the reference and biosimilars) declined by 10% to 30%. The infliximab biosimilar is one example. Although only 6% of molecule volume had converted to the biosimilar at two years post-launch, unit costs declined by 10%. Comparatively, pegfilgrastim biosimilar had 28% of molecule volume and a 20% decline in unit costs (Figure 2).

Figure 2: % Change in average molecule sales per unit since biosimilar launch

Within the buy-and-bill system, there is a range of payment methods and benefit designs. Moreover, patients have ranging abilities to save from biosimilars – be it reduced reference ASPs or lower biosimilar prices. Only the patients whose out-of-pocket costs are tied to these savings will directly benefit. There are many patients who do not benefit directly, either because of fixed co-pays, the use of co-pay cards and foundations, or supplemental coverage such as Medigap for patients covered under Medicare Part B.

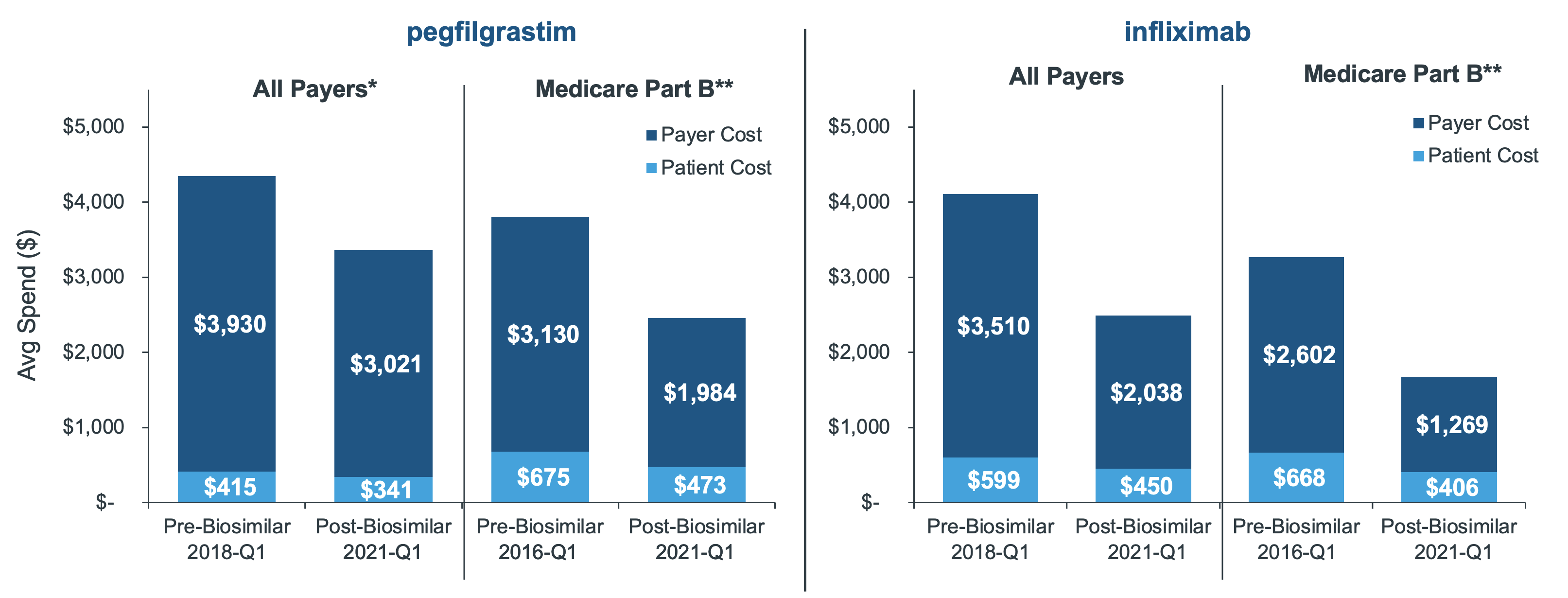

For the pegfilgrastim molecule, claim-level costs declined overall by approximately 23% across all channels and 32% in Medicare. The trend is similar for infliximab where costs declined overall by 40% and 50% in Medicare. In both instances, patients also saw a decline in costs on-par with payer savings. However, average patient out-of-pocket after biosimilar launch still exceed $300 in both molecules, which can be a prohibitive cost for anybody - let alone a senior on fixed income (Figure 3).

Figure 3: Average cost per infusion, pre- and post-biosimilar launch (community setting*)

*The claims in this analysis were limited to the community setting (as in doctors’ offices), which controlled for biases in sample that would have skewed the average by combining community with institutional (hospital). By limiting to professional claims, the analysis also focuses on settings where provider reimbursements across payer channels are more predominantly tied to ASP, highlighting where savings are the greatest.

**In order to most accurately reflect the direct-to-patient savings realized in Medicare Part B, Medigap claims were removed from the sample due to their subsidized, low out-of-pocket costs.

Source: IQVIA LAAD Medical Claims and Remittance Data, US Market Access Strategy Consulting analysis

Discussion

With market share as the sole measure, biosimilars do not appear to be succeeding in the U.S. However, if you broaden the perspective to include total healthcare savings as a consideration, biosimilars have had a clear impact as they drive down reference costs in addition to posing lower prices in their own right. This is clearly demonstrated across multiple biosimilars and is even more pronounced with more recent launches.

In addition to biosimilar uptake or reduced healthcare spending, the industry might also define success as improved patient access to treatment, which can be measured with out-of-pocket cost and utilization trends. Because most patients do not directly benefit from reduced ASP, it is critical to consider other ways to improve access, including lowering premiums and alleviating payer controls on utilization. The examples of this study show that even when patients do experience a reduced out-of-pocket cost, the amount is still hundreds of dollars per claim, and thus, often cost prohibitive for most patients.

The biosimilars in this study are physician-administered, therefore, limited to a buy-and-bill model. To date, the only pharmacy biosimilars are insulins, and only Semglee is approved as interchangeable – meaning it can be automatically substituted at the pharmacy. Soon the industry will see more pharmacy-distributed biosimilars for adalimumab (Humira) and etanercept (Enbrel), which will take on a whole new dynamic incorporating formulary restrictions and, potentially, pharmacy substitution. Yet, as with buy-and-bill biosimilars, it will be critical for stakeholders to be clear on their expectations for and measurement of success. Market share is an important metric, but total healthcare savings and patient access are also important considerations.

Most of all, the patient must not be lost in the biosimilar conversation. As policymakers consider ways to stimulate biosimilar uptake and extract more savings, what happens to patient access? How could such changes disrupt patient care and how will patients benefit from biosimilars? The results of these analyses indicate that while volume moves to biosimilars and unit costs are driven down, only some patients will directly realize any savings themselves, leaving stakeholders to determine how such savings can be translated to patient out-of-pocket and premiums.

2https://aspe.hhs.gov/reports/comprehensive-plan-addressing-high-drug-prices

3https://www.iqvia.com/insights/the-iqvia-institute/reports/a-positive-road-ahead-for-biosimilars

Biosimilars in the U.S.: Reimbursement and Impacts to Uptake

Discover how practice economics and site of care play a role in biosimilar uptake.