Measure the performance of your sales force and marketing channels, adapt your commercial strategy and gain real world competitive insights.

The second blog of this two-part series builds on the analysis of how promotion has evolved since the onset of the pandemic, and assesses differences in promotion between countries and therapy areas in the EU4&UK. These insights have been developed using IQVIA’s econometric Promo Mix model, with outputs aggregated for over four thousand products across the EU4&UK.

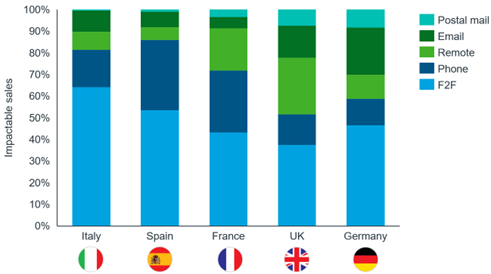

How does the channel mix of impactable sales compare between countries?

The extent of this shift towards a more digital channel mix varies considerably between countries (Figure 4), which can be attributed to differences in culture, HCP demographics and interactive preferences. Italy stands out as the country where F2F interactions account for the greatest share of impactable sales, at 64%. According to the Organisation for Economic Cooperation and Development (OECD), 56% of medical doctors in Italy were over the age of 55 in 2019, and 20% were over the age of 65.[i] As a result, doctors in Italy are older than in the other EU4&UK countries, and generally have a higher affinity for traditional, in-person channels. This will however continue to evolve in all countries as older HCPs retire and younger ones enter.

F2F interactions account for a smaller proportion of impactable sales in the UK than elsewhere, although F2F remains the leading channel. The post-pandemic reduction in engagement opportunities makes accessing physicians very challenging. Remote video calls help to bridge this gap, and a balance of push and pull communication is needed for optimal impact.

Figure 4: Channel split of impactable sales for each EU4&UK country (MAT Q1 2023)

Source: IQVIA Promo Impact model, incorporating IQVIA ChannelDynamics and IQVIA MIDAS data.

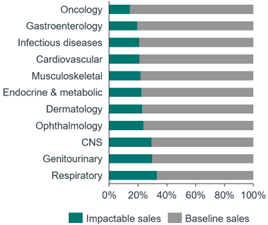

Which therapy areas stand out in terms of impactable sales?

The contribution of impactable sales to total sales varies by therapy area (Figure 5), from 14% for oncology to 33% for respiratory. For oncologists in particular, promotion is just one of many factors that influences a prescription decision: discussions with Medical Science Liaisons (MSLs) are central to clinical decisions, and there are additional considerations such as the healthcare system’s preparedness to pay, and real-world evidence. However, on the respiratory side, differentiating individual products is challenging due to the crowded nature of the therapy area, and therefore focusing on share of voice will have a greater impact on prescription decisions.

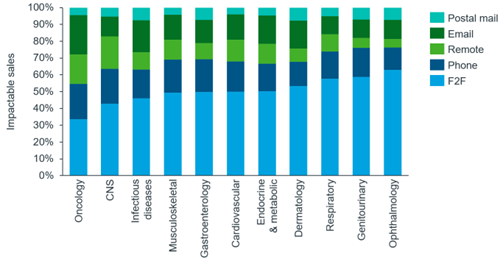

Oncology also stands out in terms of the channel split: F2F interactions account for fewer impactable sales for oncology than any other therapy area, at 34%. Part of the reason for this is that oncologists are particularly stretched currently and face large patient backlogs, due to many patients not presenting in clinical settings during the pandemic[i]. As a result, oncologists have very little time for F2F interactions, and this presents a significant challenge for such a fast-moving, highly innovative therapy area. It is therefore important to offer oncologists promotion via a diverse range of channels to maximise the opportunities to engage with them. However, for respiratory, many products are inhalers and F2F interactions are particularly beneficial here: sales representatives need to be able to demonstrate inhaler technique to HCPs, so that patients adhere to and comply with their medication. The considerable variation across therapy areas emphasises the importance of understanding the specific needs and preferences of the HCP.

Figure 5: Aggregated EU4&UK impactable sales split by therapy area (MAT Q1 2023)

Source: IQVIA Promo Impact model, with IQVIA ChannelDynamics and IQVIA MIDAS data. Each product is classified based on the therapy area for which its sales are highest, using IQVIA MIDAS Disease.

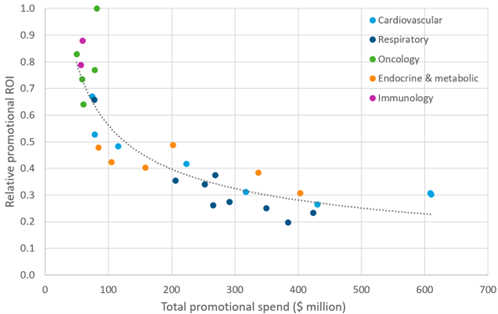

How does ROI compare for products selected from a range of therapy areas?

To understand the impact of promotion for each therapy area at a more granular level, the relative promotional ROI has been analysed for individual products. Promotional ROI is defined as the ratio of impactable sales to spend on promotion. Figure 6 includes selected products which have high ROI given their promotional spend. Products which require lower promotional spend naturally have the potential to achieve greater ROI, and they are broadly clustered by therapy area.

Figure 6: Aggregated EU4&UK relative promotional ROI for selected products (Q2 2016 to Q1 2023)

Source: IQVIA Promo Impact model, with IQVIA ChannelDynamics and IQVIA MIDAS data. This chart includes selected products which have high ROI given their promotional spend. Products with total promotional spend less than $50 million have been excluded. Each product is classified based on the therapy area for which its sales are highest, using IQVIA MIDAS Disease.

Respiratory, cardiovascular and endocrine & metabolic products have the highest spend and lowest ROI, due to requiring substantial promotion to many primary care physicians, such as general practitioners, nurses and pharmacists. In contrast, oncology products have lower promotional spend and higher ROI: their promotion generally targets a smaller HCP universe, comprising mainly specialist physicians in secondary care settings. In addition, the high value of many innovative oncology therapies naturally contributes to high promotional ROI.

However, Figure 6 reveals variation within each therapy area: even among the products with highest promotional ROI, there is a wide spectrum of promotional performance. This suggests that attempting to navigate the promotional landscape has been challenging for many companies, and as a result, there is often room for promotional ROI to be significantly improved.

How can life sciences companies maximise the impact of their promotion?

The promotional landscape is evolving and becoming increasingly complex. From a life sciences company perspective, it is important to appreciate the proportion of sales which are impactable for individual products, as this evolves throughout the lifecycle. Differences in impactable sales were also examined across countries, therapy areas and products across the EU4&UK, showing how the engagement environment is shifting continuously but heterogeneously. Companies need to adapt accordingly: it is of paramount importance to orchestrate and optimise the channel mix to maximise impactable sales. At the same time, companies can benchmark progress against products that have particularly high promotional ROI.

Adjusting channel mix does not happen in isolation. Channel mix is of course one of many elements affecting the overall impact of promotion. The content is crucial, as are the people skills and customer understanding of the sales representatives. In addition, the sequence and role of each interaction must be carefully considered, to build a cohesive customer journey.

Overall, it is clear that the pandemic accelerated the rise of digital channels and, despite some movement back to more traditional channels, the digital components appear set to remain. Transitioning towards a more digital approach could also provide a means to lower promotional spend for life sciences companies, but it will only be beneficial if appropriately aligned with the most favourable combination of channels. At the same time, the importance of F2F interactions must not be underestimated; F2F interactions now have greater ROI than before the pandemic, and they remain a fundamental way of engaging HCPs in personal discussions. It is therefore becoming ever more important to adopt and embrace omnichannel promotion with, for optimal ROI, a product-specific channel mix that meets HCPs’ needs.

Enjoyed this topic? Listen to our authors engage in an in-depth discussion in this on-demand webinar.

References

[i] Firestorm to Burnout: The Impact of the Pandemic on Healthcare Professionals - IQVIA

Read part one here.

Related solutions

Maximize the value of your brand with personalized, precise, and efficient communications.