Obesity has become a major global health crisis impacting every corner of the world, with some of the most rapid increases in prevalence seen in low- and middle-income countries.

Deep dive into our most recent insights in our Obesity Knowledge Hub.

What’s different in 2024 is that we are seeing the birth of a major new market for effective prescription medications which promise unprecedented impact not just on obesity, but on the health issues associated with obesity. The market is also seeing unprecedented willingness by patients to pay out of pocket, addressing the otherwise significant market access challenge, at least for wealthier patients, and creating new commercial opportunities, which will also be seen for the support of patients on their journey to weight reduction and better health. The rise of a new mega-sized therapy market for obesity agents could be a powerful contributory factor to the debut of the world’s first trillion-dollar value Life Sciences company, something which has not yet happened but in 2024 is moving to a real possibility. On the flipside, there are challenges: for example, concerns about cost to healthcare systems and equity of access for patients with the greatest unmet needs, or the possible impact on Medtech currently used by patients suffering from obesity related conditions – for example knee replacements for overweight patients with eroded joints or CPAP machines for sleep apnoea, a complication of obesity.

Sizing the challenge

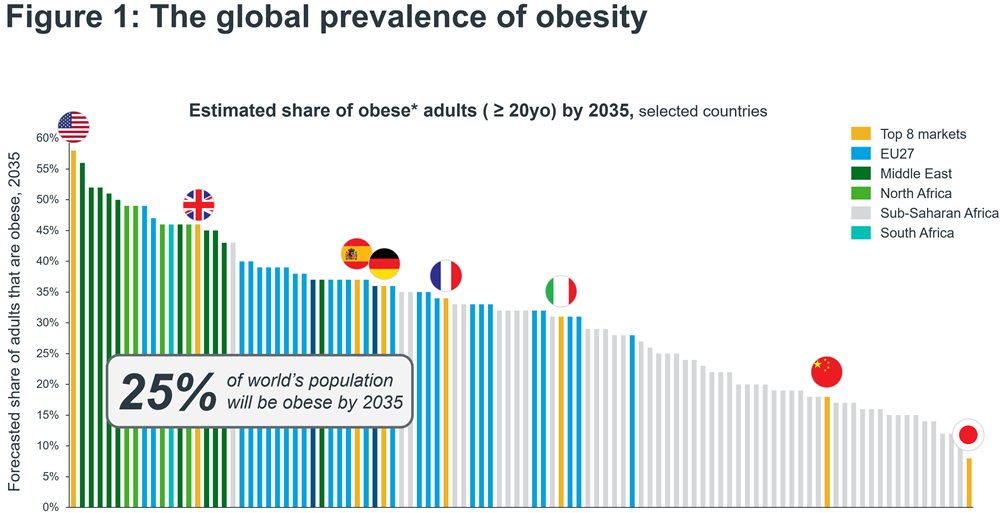

The global prevalence of obesity, defined as having a body mass index (BMI) equal to or greater than 30 kg/m2, is expected to rise from 14% of the world’s population in 2020 to 25% by 2035, or 1.9 billion people (Figure 1). When the overweight population is included, i.e. those having a BMI equal to or greater than 25 kg/m2 but less than 30 kg/m2, prevalence more than doubles to 4 billion1. This dramatic trend has a huge economic impact, estimated at $4 trillion in 2035 or 2.9% of global GDP, as a result of higher healthcare cost and lost economic productivity2.

*Obesity defined as ≥30kg/m2

Sources: IQVIA Thought Leadership; World Obesity Federation, World Obesity Atlas 2023

Unsurprisingly, weight loss medications have captured innovators’ attention as potential solutions, however, the obesity market has a history of many false dawns, as drugs in the past failed to deliver meaningful efficacy while some had serious safety issues, e.g., Fen-Phen, which was eventually withdrawn from the market due to cardiac risks3.

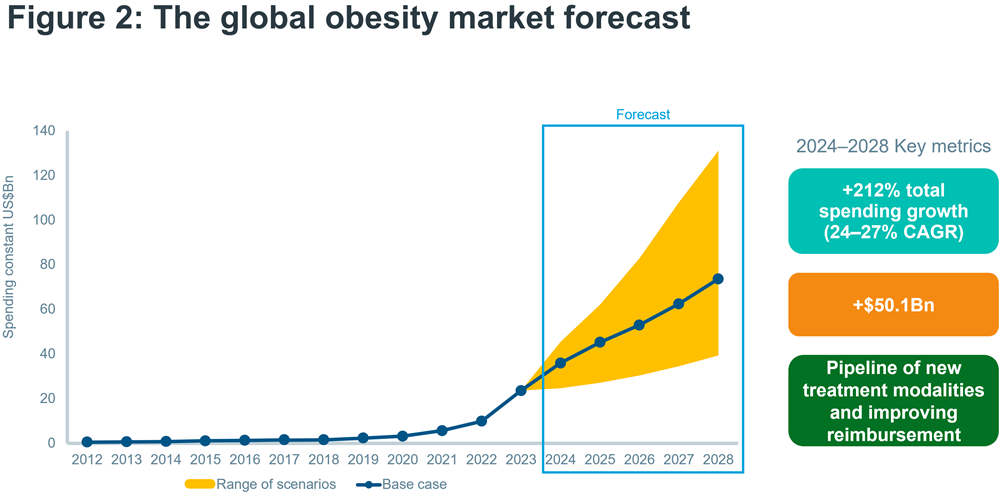

The arrival of the GLP-1 receptor agonists, especially Wegovy, marked an inflection point for the obesity market, because for the first time pharmacological interventions delivered meaningful weight loss of 10-15%. Global obesity spending reached nearly $24bn in 2023, an over sevenfold growth in value in just three years, driven by the advent of new agents, and from 2024 onwards the market is forecasted to accelerate rapidly, with a possible 24-27% CAGR to 2028, and a potential value of up to $131bn by 2028, according to the IQVIA Institute’s Global Use of Medicines 2024 report4.

A therapy area market with $131bn of global value would immediately become the fourth member of the “mega-therapy areas” which are substantially more valuable, and drive more of the value growth, of the global prescription medicine market. For the past decade, the three mega-therapy areas have been Oncology (which will continue, under any scenario, to be the world’s most valuable therapy area for the foreseeable future), Diabetes, and Immunology. This hegemony is about to be permanently disrupted by a new mass market, chronic disease area, which unusually is seeing very high levels of out of pocket spend- in February 2024, Novo Nordisk’s CEO noted that in Europe, 80% of Wegovy sales so far were paid for out of pocket by patients- showing, against preconception, that European patients were as willing as Americans to pay for their own obesity medications5. This will have implications not just for obesity, but for the pharmaceutical market as a whole.

Leading diabetes players Novo Nordisk and Lilly are set to dominate the race for the obesity opportunity. However, its future trajectory is far from linear as many uncertainties remain, e.g., acceptance of obesity as a chronic disease, budget impact faced by payers and health systems’ willingness and ability to pay, the readout of further cardiovascular outcomes trials after the high profile results of 2023’s SELECT trial for Wegovy, or new entrants challenging first generation therapies with alternative mechanisms of action (MoA) to address shortcomings such as gastrointestinal tolerability, current drugs being injectables, or the durability and quality of weight loss which distinguishes between fat and lean body mass.

Innovation landscape

The current obesity pipeline has over 80 clinical-stage assets that are being investigated in trials specifically for this condition. It is dominated by GLP-1 receptor agonists which on their own or in combination with GIP agonists are the largest group of candidates, with Glucagon/GLP-1R dual agonists and glucagon/GLP-1R/GIP triple agonists second and amylin analogues third. The remainder comprises a range of different mechanisms of action, e.g., SGLT2, MGAT2, MC4R, PDE5, PYY and insulin receptor modulator. Over one third of clinical stage assets are oral therapies, seeking to offer effective weight loss combined with greater convenience.

Novo Nordisk and Lilly are setting a high benchmark for weight loss with their novel obesity treatments, including approved Wegovy, Zepbound and other assets currently in development. Dual- and triple action approaches which simultaneously target multiple pathways, for example, GLP1R/GIP (tirzepatide), GLP1R/GIP/glucagon (retatrutide) or amylin/GLP1R (CagriSemra) appear more potent and may push weight reduction to the mid-20% range and possibly beyond, while oral options seek to deliver levels of efficacy seen with injectables.

As competition is heating up, ultimately head-to-head trials will be needed to demonstrate unambiguous differentiation, which Lilly has just embarked on with its bold SURMOUNT-5 obesity trial which puts its Zepbound against Novo’s Wegovy6.

At the same time, compelling cardiovascular outcomes data will be equally critical for commercial success to demonstrate value to health systems:

- Novo’s SELECT trial read out in 2023, demonstrating the impact of Wegovy-induced weight loss was a statistically significant 20% reduction in a composite endpoint consisting of cardiovascular death, non-fatal myocardial infarction, or non-fatal stroke in 17,604 overweight or obese patients with prior cardiovascular disease. The August 2023 announcement of topline results was followed in November 2023 by a presentation of detailed results7, which revealed a statistically significant reduction in non-fatal myocardial infarction of 28% and smaller reductions in cardiovascular death and non-fatal stroke which were not statistically significant over the length of the trial (up to five years). Secondary confirmatory and supportive endpoints also showed benefits, including all cause death reduction of 19%. Thus, the SELECT trial exceeded expectations (many commentators predicted the topline reduction to be likely sub-20%), but also underlined the need for further outcomes trials to clarify other potential benefits, as well as, for competitors, meeting or exceeding the performance of Wegovy.

- Lilly’s SURMOUNT-MMO trial investigates the effect of Zepbound on the reduction of morbidity and mortality in obese adults. Its primary outcomes measure is time to first occurrence of any component event of a composite endpoint comprising all-cause death, non-fatal myocardial infarction, non-fatal stroke, coronary revascularization, or heart failure events that result in hospitalization or urgent hospital visits. Secondary endpoints assess impact on multiple co-morbidities, e.g., MACE-3 events, onset of T2D, hypertension, heart failure or renal disease. Trial completion is estimated for Q4/20278.

- Lilly’s ongoing SURPASS-CVOT, while focused on cardiovascular outcomes in T2D patients and comparing Mounjaro (i.e. tirzepatide) vs. Trulicity, is expected to read out in Q4/2024, before SURMOUNT-MMO, and thus could provide important, earlier outcomes data in support of tirzepatide even for its obesity indication9.

Future competitors will have to clear a high bar to challenge today’s leading two players, possibly delivering weight reduction of 20% or more while demonstrating beneficial cardiovascular outcomes. Recent phase 2 trial readouts from Boehringer Ingelheim/Zealand and Innovent illustrate the battle ahead. Their respective glucagon/GLP-1R dual agonist assets, BI 456906 and mazdutide, delivered weight loss of ~15%, which puts them in the efficacy range of Wegovy, but trailing the 21% weight reduction seen with tirzepatide in a cross-trial comparison, with its inherent caveats.

However, successful challengers will also look beyond headline efficacy numbers to other differentiators, such as tolerability, the quality of weight loss and its durability. For example, overweight and obese T2D patients treated with activin type 2 receptor antagonist bimagrumab in a phase 2 trial achieved net weight loss, comprising significant loss of total body fat mass while gaining some lean mass (i.e. muscle), in addition to seeing improvements in glycaemic control10. Furthermore, earlier trials of bimagrumab showed that weight and fat loss were maintained for 12 weeks after patients stopped treatment.

Beyond biopharma innovators, other types of players, such as telehealth and digital health companies, have also been attracted by the obesity opportunity, for example, offering prescription services for anti-obesity drugs as part of comprehensive weight loss or disease management programmes for chronic conditions, which typically include counselling on behavioural, nutrition and activity changes with the aim to achieve lasting weight reduction11.

The future obesity market: Key drivers

Already, 2023 brought a step-change in the treatment paradigm for obesity by introducing highly effective pharmacotherapy options. However, despite increasing prevalence and high unmet need, the extent of their commercial success and the wider outlook for the obesity market are still fraught with uncertainty (Figure 2), and 2024 is the year when the likely commercial path for the obesity market becomes more apparent.

Source: IQVIA Forecast Link, IQVIA Institute, Dec 2023

Global Use of Medicines 2024: Outlook to 2028. Report by the IQVIA Institute for Human Data Science.

A significant expansion of the market for anti-obesity pharmacotherapies to reach the upper limit of IQVIA’s 2028 value predictions depends on a number of critical drivers.

- Compelling CVOT data: Ultimately, health systems attribute value to cardiovascular outcomes, not weight loss on its own. The successful readout of Novo’s SELECT cardiovascular outcomes trial represents a moment of truth for the future trajectory of the obesity market, with profound ramifications beyond Wegovy itself. Compelling outcomes data that demonstrate the value of weight management will be critical for any expansion of access and reimbursement and change in clinical practice. Currently (February 2024), the EMA is considering the wider use of Wegovy to include reducing cardiovascular events – this is critical for coverage in many European health systems, including the largest, Germany, which refuse to cover it for weight loss alone. Lilly and other followers will need to generate their own evidence to support cardiovascular benefits of their own obesity treatments to compete on coverage and use. In the long run, real world studies will become essential to substantiate benefits, including weight loss and CV outcomes, achieved in an everyday life setting.

- Treatment guideline updates: A change in clinical practice is an important driver for market expansion. In the U.S., for example, only 2% of the obese adult population were historically treated with anti-obesity drugs, due to a combination of lack of clarity about the role and value of pharmacotherapies (which were also less effective and sometimes with greater side effects than the recently launched treatments), limited insurance coverage and resulting out-of-pocket costs12. Updated treatment guidelines for obesity which specify weight management targets for obese patients, with or without T2D, are needed to codify positive CVOT data and embed their implications in clinical practice for optimal CV risk reduction. This in turn would formalise the role of pharmacotherapies in the treatment of obesity and, in combination with educational efforts, would improve diagnosis and treatment rates from historical lows.

- Longer treatment duration: Several real-world studies assessing the use of Saxenda for weight management found patients’ typical persistence with therapy lasts for around 5-7 months13. Compared to Saxenda, patients in clinical trials receiving next generation treatments Wegovy or Zepbound achieved more than three times the weight reduction, or ~15-20% vs. ~5%. Furthermore, under clinical trial conditions Wegovy and tirzapetide continued to deliver significant, incremental weight loss until week 48, and even beyond for higher doses14. It is therefore plausible to expect that patients will remain on therapy for much longer with these new, potent anti-obesity treatments as they continue to see weight loss benefits, while positive cardiovascular outcomes data would further strengthen this case. Even so, such optimistic assumptions are yet to face their real-world test.

- Access and reimbursement expansion: Historically, coverage of weight loss medications by both private and public payers has often been highly restricted, and in many countries such treatments are not reimbursed at all, reinforcing health inequities. The arrival of next generation therapies which deliver meaningful weight reductions has reignited the debate about expanding reimbursement and access to such treatments.

In the U.S., the yet to be passed Treat and Reduce Obesity Act of 2023 seeks to lift the statutes prohibiting Medicare coverage of obesity drugs15. However, the substantial budget impact of covering obesity treatments is a major concern, which given the size of the potential target patient population could even exhaust the entire Part D budget under certain scenarios. Meanwhile, commercial payers are divided on the value of obesity medicines and coverage has shown wide variations. - Investment in, and new thinking on, Real World Evidence programmes for Obesity research: Real world data will be critical to understand the real, long-term value of the use of obesity agents, because it is clear that there is a highly diverse patient body, and social determinants of health are increasingly recognised as a crucial element in obesity research, because the role of the patient themselves in driving treatment outcomes is critical, especially when the patient pays for the obesity treatment out of pocket, and because of the importance that new digital technologies can have in collecting a broader range of data, including patient reported outcomes16.

Outside the U.S., some countries are expanding access to new anti-obesity therapies, e.g., the UK and France17, but tight restrictions apply in the reimbursed sphere.

For example, the UK’s NICE18 recommends Wegovy for weight management alongside diet and exercise, but it is restricted to (i) patients with at least one weight-related comorbidity, and (ii) a BMI of at least 35.0 kg/m2; while (iii) reimbursement is limited to a maximum of two years, and (iv) the drug must be used within a specialist weight management service providing a multidisciplinary approach. Only by exception, patients with a BMI of 30.0 kg/m2 to 34.9 kg/m2 may be considered if they meet additional guideline criteria.

As noted by Novo Nordisk’s CEO, it is both surprising but also positive for the commercial development of the obesity market that large populations in both the US and Europe have shown willingness to pay for private prescriptions of Wegovy and other agents out of pocket. New business opportunities are rapidly developing for, for example, pharmacy chains in supporting the access to the private market for obesity treatments.

To unlock wider and more equitable access to novel obesity treatments, however, positive cardiovascular outcomes data will be absolutely critical to demonstrate substantial cost-savings for health systems from medication-assisted weight loss by avoiding downstream complications from obesity-related comorbidities. In addition to outcomes data, payers will be guided by cost-effectiveness considerations, e.g., as assessed by European HTA bodies or ICER, with implications for drug prices to meet acceptable cost-effectiveness thresholds.

Notwithstanding the buzz surrounding the novel weight loss treatments, which is vividly playing out on social media and beyond, capturing this commercial opportunity will still require an orderly, rigorous approach to create and shape a new market. For example, medical-led engagement of HCPs, professional societies and guideline setting bodies will be critical to educate, disseminate compelling evidence and facilitate the adoption of new clinical practice. The same applies to payers and policy makers, to help elevate obesity as a public health priority that deserves attention and adequate funding.

Undeniably, this is an exciting time for the obesity market as it is facing a major inflection point. Through 2024 and beyond we will find out whether the stars are indeed aligning to unlock what could be one of the most significant commercial opportunities the pharmaceutical industry has seen in decades.

More from IQVIA on Obesity and Cardiometabolic Innovation:

https://www.iqvia.com/library/white-papers/a-renaissance-for-cardiometabolic-innovation

https://www.iqvia.com/blogs/2023/11/beyond-obesity-novos-select-re-defines-cardiovascular

[1] World Obesity Atlas 2023, The World Obesity Federation: https://www.worldobesity.org/resources/resource-library/worldobesity-atlas-2023

[2] Economic impact of overweight and obesity to surpass $4 trillion by 2035; World Obesity Federation: https://www.worldobesity.org/news/economic-impact-of-overweight-and-obesity-to-surpass-4-trillion-by-2035

[3] 2 Diet drugs are pulled off market, Washington Post, 16 September 1997: https://www.washingtonpost.com/archive/politics/1997/09/16/2-diet-drugs-are-pulled-off-market/f4f80a0c-ba83-4534-a537-bc37b24b3916/

[4] The Global Use of Medicines 2024 - IQVIA

[5] https://www.ft.com/content/bbbe8543-263c-4e5b-a567-2ef05f2b3138

[6] In heavyweight obesity fight, Eli Lilly launches Mounjaro head-to-head trial against Novo Nordisk’s Wegovy; Fierce Pharma article, 21 January 2023: https://www.fiercepharma.com/pharma/heavyweight-obesity-fight-lilly-launches-mounjaro-headhead-trial-against-novos-wegovy

[7] https://www.iqvia.com/blogs/2023/11/beyond-obesity-novos-select-re-defines-cardiovascular

[8] . Semaglutide Effects on Heart Disease and Stroke in Patients With Overweight or Obesity (SELECT): https://classic.clinicaltrials.gov/ct2/show/NCT03574597

[9] A Study of Tirzepatide (LY3298176) on the Reduction on Morbidity and Mortality in Adults With Obesity (SURMOUNT-MMO): https://clinicaltrials.gov/ct2/show/record/NCT05556512

[10] Trial Finds Bimagrumab Aids Weight Loss in Patients With T2D, Obesity; AJMC, 18 January 2021: https://www.ajmc.com/view/trial-finds-bimagrumab-aids-weight-loss-in-patients-with-t2d-obesity

[11] Digital health companies making a long-term play for the $100B weight loss drug market; Fierce Healthcare article, 9 May 2023: https://www.fiercehealthcare.com/health-tech/telehealth-companies-target-100b-weight-loss-drug-market

[12] Thomas CE, Mauer EA, Shukla AP, Rathi S, Aronne LJ. Low adoption of weight loss medications: A comparison of prescribing patterns of anti-obesity pharmacotherapies and SGLT2s. Obesity. 2016;24:1955–61. https://doi.org/10.1002/oby.21533

[13] Wharton S, Haase CL, Kamran E, Liu A, Mancini J, Neish D, Pakseresht A, Power GS, Christensen RAG. Weight loss and persistence with liraglutide 3.0 mg by obesity class in the real-world effectiveness study in Canada. Obes Sci Pract. 2020 May 9;6(4):439-444. https://doi.org/10.1002%2Fosp4.420.

Wharton S, Haase CL, Kamran E, Liu A, Mancini J, Neish D, et al. Real-world persistence with liraglutide 3.0 mg for weight management and the SaxendaCare® patient support: https://doi.org/10.1002%2Fosp4.419.

Haase CL, Serratore Achenbach MG, Lucrezi G, Jeswani N, Maurer S, Egermann U. Use of Liraglutide 3.0 mg for Weight Management in a Real-World Setting in Switzerland. Obes Facts. 2021;14(5):568-576. https://doi.org/10.1159%2F000518325

[14] Once-Weekly Semaglutide in Adults with Overweight or Obesity, STEP 1 Study Group; N Engl J Med 2021; 384:989-1002; https:// www.nejm.org/doi/full/10.1056/NEJMoa2032183.

Tirzepatide Once Weekly for the Treatment of Obesity; SURMOUNT-1 Investigators; N Engl J Med 2022; 387:205-216. https:// www.nejm.org/doi/full/10.1056/NEJMoa2206038

[15] Treat and Reduce Obesity Act of 2023; 118th Congress (2023-2024): https://www.congress.gov/bill/118th-congress/senate-bill/2407

[17] Novo Nordisk’s Wegovy passes NICE checkpoint on course to blockbusterland; Fierce Pharma article, 8 February 2022: https:// www.fiercepharma.com/pharma/novo-nordisk-s-wegovy-passes-nice-checkpoint-course-to-blockbuster-land.

France renews Early Access to Novo’s Wegovy for Obesity; Navlin Daily, 2023: https://www.navlindaily.com/article/18854/france-renews-early-access-to-novo-s-wegovy-for-obesity

[18] . NICE Technology appraisal guidance: Semaglutide for managing overweight and obesity; 8 March 2023: https://www.nice.org.uk/guidance/ta875/resources/semaglutide-for-managing-overweight-and-obesity-pdf-82613674831813