Article

The Mystery Shopper Exercise: Solving for the Unknowns in Marketing

One way to measure your performance in retail pharmacies is, of course, to monitor sales volume. But that has its limits. Secondary research can’t help you understand the “whys” behind performance or reveal how to improve it. A “mystery shopper” exercise – in which individuals are hired to pose as shoppers and report back on their experiences – can help you do just that. In fact, there’s no better way to put yourself in the shoes of your end customers than to experience what they do as they shop and seek advice from pharmacists.

For consumer health companies and manufacturers of over-the-counter pharmaceuticals, mystery shopper engagements can be designed to answer questions such as:

- What return am I getting from the investment in my pharmacy program?

- What can be gained from optimizing how pharmacists explain my brand to consumers?

- What obstacles stand in the way of increasing customer loyalty?

- How do pharmacy customers experience shopping for my brand?

To illustrate how a mystery shopper exercise works, let’s walk through a real-life example...

A consumer health company had invested heavily in training and certifying Belgian pharmacists on how to advise consumers about its products. After the program had been up and running for two years, the company lacked a clear view into the program’s value. The brand manager wanted to evaluate the current approach before possibly modifying and/or expanding it. The key questions were:

- How well were pharmacists who had been certified through the program sharing information about the company’s products to consumers when they needed advice?

- How did consumers perceive the experience?

To get answers, the company engaged IQVIA to manage a mystery shopper exercise in Belgian pharmacies. We began by designing a questionnaire for the company’s approval that would form the basis of two different shopping scenarios. With the company’s help, we selected 70 pharmacies for the research, with half in the test group and half in the control group, which consisted of pharmacies that had not participated in the certification program. The pharmacies were geographically diverse and both cohorts were matched on key characteristics to avoid bias in the sampling.

Next, we gathered a pool of mystery shoppers. They were sent to each pharmacy twice, once for each scenario. The mystery shoppers were instructed to record:

- How visible the program was from the outside and inside of the pharmacy

- The extent to which pharmacists devoted time to asking open ended questions and providing full product information

- Whether the pharmacist offered proactive advice and recommended the company’s product

- A satisfaction rating of the overall experience

IQVIA analysists then interpreted the findings, drew conclusions, and made recommendations to the company. Results were presented in a very visual format so that it was possible to instantly grasp the differences between the test and control groups. Figure 1 is an example of such reporting and shows a significant difference in the shoppers’ views of the pharmacists’ product knowledge between the test and control group.

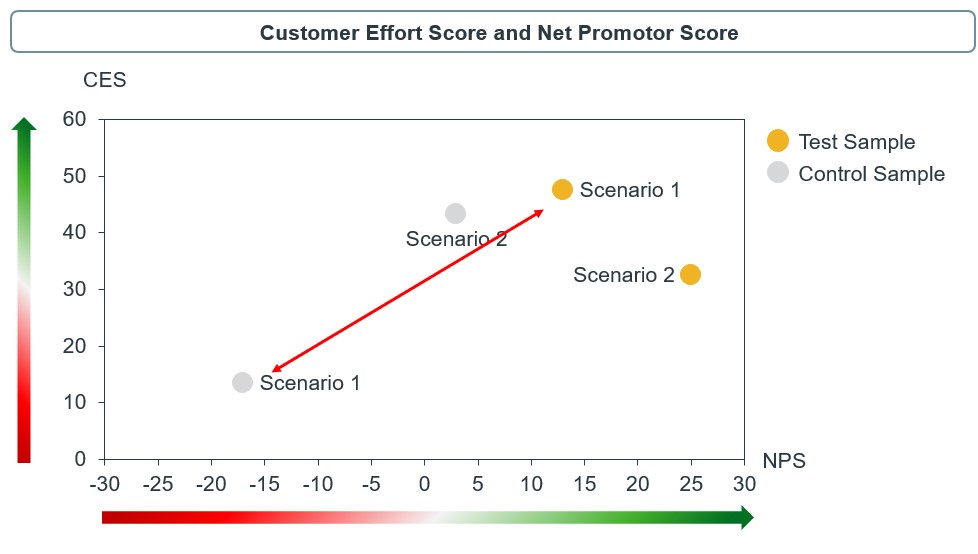

Based on the mystery shoppers’ ratings, IQVIA was able to assign each pharmacist a Customer Effort Score reflecting the ease with which the customers’ issues were solved, and a Net Promotor Score, which measures the overall feeling that shoppers had toward the experience. Sample results are shown in Figure 2, indicating that in Scenario 1, the ratings of overall experience were markedly more positive for shoppers in the test vs. the control group.

This represents just a peak at the type of results that can be derived from a mystery shopper exercise to protect the identity of this particular client company. It should be clear, nonetheless, that the research revealed valuable insights for the company as it decided how to invest in its certification program in the future.

To learn more about the applications and mechanics of mystery shopper research, please email Joris Smet, Consultant.