Discover new approaches to cardiovascular clinical trials to bring game-changing therapies to patients faster.

Introduction

Any major societal shift now plays out first and foremost on Social Media, and healthcare events are no exception. Social Media not only reflects but also distorts the trends it documents, and can create narratives which diverge from reality, as they play back to and influence the perceptions of individuals and society as a whole. Therefore, it is critical to understand and track the Social Media discourse on obesity, from both healthcare professionals (HCPs) and the general public. This blog outlines recent findings from IQVIA’s Social Media Insights programs on obesity from both HCPs and the general public across the US, UK, Germany, France, Italy, and Spain.

Obesity is a topic guaranteed to generate discussion since the advent of Social Media, but the more recent launch of effective prescription medications to treat people who are overweight and live with obesity, on and off label, has all the characteristics of a Social Media phenomenon. Obesity is an issue which practically everyone is directly or indirectly affected by, combining often controversial and divisive opinions, celebrity gossip, headline stories and memes. For current and potential patients, therefore, Social Media is a potent, confusing, and often intimidating mix, where nuggets of genuinely useful insight, real life experience and practical help compete with what is less helpful, misleading, and sometimes actively harmful.

Pharmaceutical companies marketing or developing anti-obesity medications can never hope to fully control the obesity Social Media narrative; but that does not mean they can ignore it. At base, they need to be aware of the volume, sentiment, and themes in the content of the Social Media posts relating to their brand, and obesity treatment more broadly, for both potential and current patients and for HCPs. Because of the fast-moving situation in obesity, with multiple new products, labels, issues arising continuously, broad-based tracking across all key markets is critical. Currently, the US leads on Social Media volume, but this will evolve, and understanding the baseline of other countries as they absorb developments of the market such as launches and new trial results and labels is important; Social Media conversations do vary considerably between countries, as shown in the IQVIA data and analysis in Exhibit 1.

Exhibit 1: Social Media mentions of obesity and obesity treatment brands across key countries and over time.

Such a high-profile area as obesity inevitably attracts an exceptionally wide range of discussion, not all of it well informed or informed by direct experiences of either obesity or obesity treatment, and the challenge is separating the signal from the noise. However comments, even when ill-informed, create impact if broadcast loud enough and it’s important to understand sentiment at the broadest level as well as at the informed level, because it will affect potential patients’ view of obesity as a disease, their desire to use these agents, and the likelihood that they do go down the path to pharmacotherapy (as well as potentially their experience when on it). The future of prescription obesity treatment will see both the out-of-pocket and the reimbursed market segments evolve.

Out-of-pocket has led in market evolution and therefore influences the Social Media conversation, but as reimbursement of these medications evolves, and the types of products, labels, and patients they are reimbursed for, we can expect a growing conversation among HCPs and an evolving conversation with patients.

1At a rough estimate, only around 1% or less of the world’s population with BMI 30 or higher have been treated with the latest Obesity medications or Wegovy and Mounjaro/Zepbound (IQVIA author estimates, 2024)

This blog’s research is based on IQVIA’s Social Media insights program. IQVIA Social Media Intelligence enables life sciences companies to combine power of best-in-class AI with the validation and experience of a human team of experts, to inform the drug commercialization process.

A vast library of 1.3 trillion posts, collected over 10 years, informs a language-agnostic AI, covering a broad range of countries and social platforms including the ones such as forums, Reddit, and Facebook that host detailed consumer discussions. Several other platforms such as X, Instagram, and TikTok hosting influencer and self-identified HCP posts are also covered.

Because the level of knowledge, social discussions are very different between HCPs and the general public, we will address these separately, starting with HCP social discussions.

Healthcare professional (HCP) online discussion insights

IQVIA’s Social Media Insights program can focus on discussions specifically by identified HCPs on open access platforms.

HCP engagement in online discussions on obesity has significantly increased since 2021, when Wegovy was first approved in the US – with a key focus on raising awareness of the importance of adopting pharmacological treatments for obesity, separate from lifestyle changes. Social Media insights shows that HCPs are actively participating in discussions on the importance of taking obesity medication by evaluating the pros and cons, as well as explaining the mechanism of action (MOA) in detail to raise awareness; conducting Q&A sessions on their personal channels for patients to manage obesity and its related side effects; and strongly emphasising the importance of taking obesity medication under physician supervision. HCPs advocate for the efficacy of the newer obesity pharmacological agents and discuss ways to manage the side effects of these medications.

Due to obesity medicine shortages in the US, compounding* pharmacies have been an increasingly important source of obesity medicine supply in the US; this is an overwhelmingly US phenomenon. US HCPs have expressed concerns about patients buying from compounding pharmacies due to perception of severe side effects, formulation questions and other concerns. It is worth noting that compounding pharmacies have not been highlighted as an issue outside of the US by HCPs.

The brand name Ozempic, although relevant only for the diabetes indication of semaglutide, has a higher recognition with both HCPs and patients in social discussions of obesity than any other brand, including the brands which are in fact specifically approved for obesity, Wegovy, and Mounjaro/Zepbound, because of its earlier off label use. Overall, HCPs highlight the needs for more research to be carried out on the willingness to tolerate side effects and the necessity of weight loss medication.

2*Compounding is the creation of a pharmaceutical preparation—a drug—by a licensed pharmacist to meet the unique needs of an individual patient (either human or animal) when a commercially available drug does not meet those needs. The phenomenon of widely available compounded obesity prescription medications is confined to the US. In June 2024, Eli Lilly issued an open letter addressing certain practices concerning the use of their tirzepatide medications, Mounjaro® and Zepbound®. The letter highlighted the prevalence of inappropriate practices, including the actions of compounding pharmacies and the dissemination of unsafe online and Social Media advertisements. Eli Lilly strongly emphasized the crucial importance of using these medications safely and under the guidance of HCPs (Eli Lilly and Company , 2024).

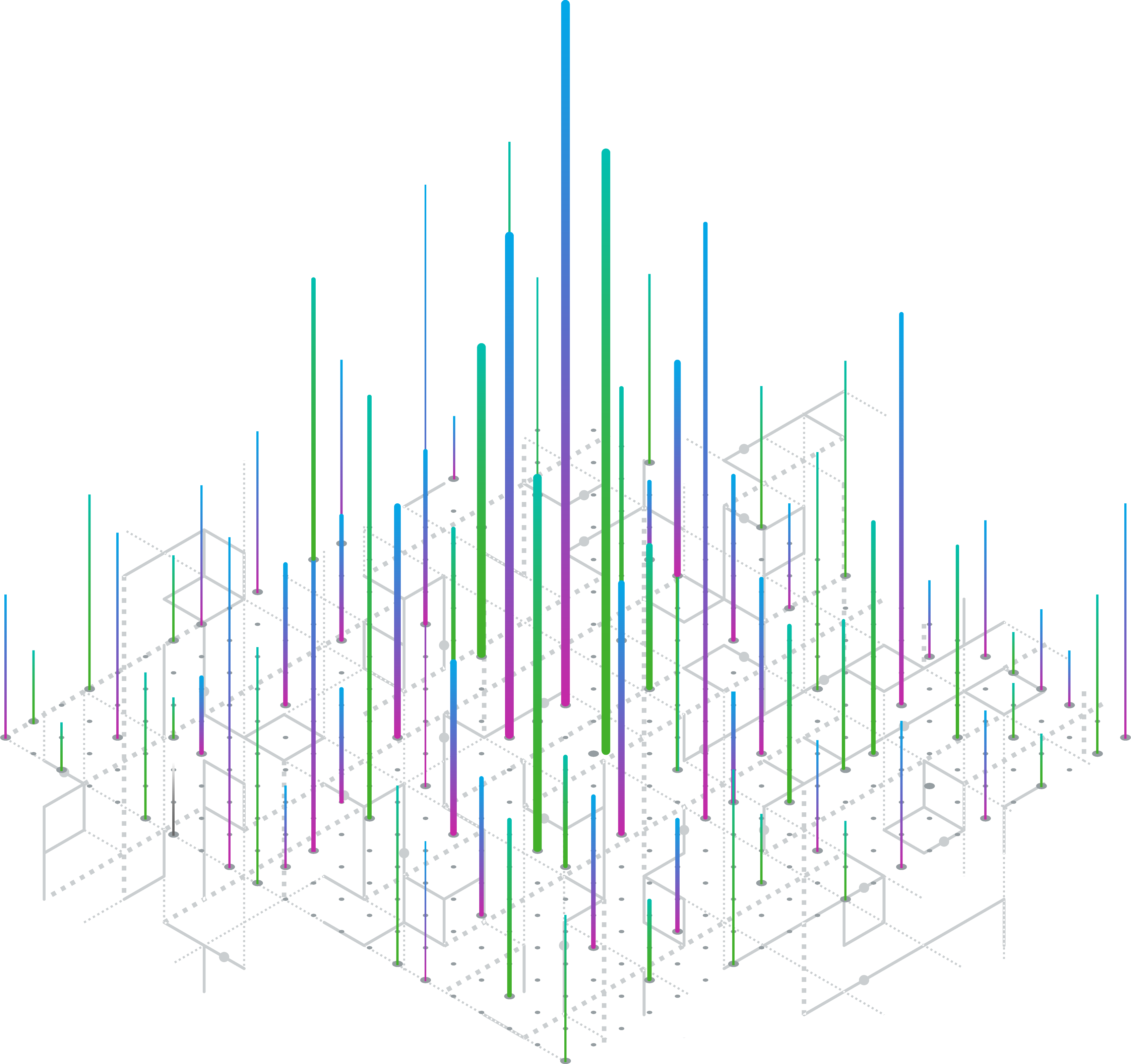

Insights from the HCP social discussions highlight the extensive online engagements on obesity-related clinical trials over the last three years, with approximately six million mentions observed, overall (HCPs plus general public). This is likely to expand significantly for HCP Social Media discussions in the future- Exhibit 2 shows the extensive late-stage clinical trial programmes focused on expanding indications and improving outcomes in cardiovascular and metabolic diseases for the lead products - semaglutide, tirzepatide and survodutide. Semaglutide and tirzepatide are in the market and survodutide is shortly to be launched.

Exhibit 2: The major outcomes clinical trial programme for three key obesity molecules (semaglutide – Wegovy, tirzepatide – Mounjaro/Zepbound, and survodutide (yet to be approved)

Online HCP engagements have been particularly driven by the efficacy of semaglutide and similar treatments in reducing weight and managing cardiovascular risk. In May 2024, these topics saw a notable spike in online conversations, indicating a growing interest and awareness among the public and HCPs. It is critical to emphasize the importance of these clinical trials in advancing obesity treatment and the positive impact they have on patient outcomes.

IQVIA’s analysis of HCP and professional discussion, Exhibit 3, sees SELECT the most discussed trial in relation to CV outcomes, with STEP the most discussed trial for heart failure and a more spread conversation for NASH/MASH, but SURMOUNT the most discussed trial.

Exhibit 3: Overall conversations volumes and relative interest for key clinical trials by HCPs and others.

The CV-outcomes trial group, especially the SELECT trial, was the most discussed by online users, including HCPs, with over 36,000 conversations related to it in the past two years – discussions gained momentum following the release of the trial data by Novo Nordisk in August 2023. HCPs were particularly vocal about the SELECT trial results, appreciating the remarkable long-term weight loss effects of semaglutide, as well as its impact on major adverse cardiovascular events (MACE) and its cardioprotective mechanism of action (MOA). Some HCPs are also advocating for insurance coverage for the drug.

In the coming years there will be a steady accumulation of trial outcomes on the leading obesity agents, which if positive will cement their value as preventative agents across a wide range of serious cardiometabolic risks and conditions. HCP Social Media discourse on these outcomes will be increasingly important as the obesity market becomes more healthcare system funded, competitive and complex.

Patients and potential patients: the Social Media view of obesity treatment and obesity medications

Any comment on Social Media from the general public about the use of prescription obesity medications must be viewed in the knowledge that the number of people worldwide who are currently using these medicines numbers at best a few millions, whereas the number of people who are obese, defined as BMI of 30 or over, has now topped one billion. Therefore, the vast majority of people living with obesity, possibly 99%, have not yet used the new obesity medications. Social Media discourse on obesity and obesity brands started to accelerate dramatically post 2018, and whilst mentions of obesity peaked in the US, the country with the highest volume of discussion in our study, in 2021 and have fallen a little since, the volume of mentions of obesity medicine brands (and other GLP-1s which do not in fact have obesity indications) grew very strongly since 2021 and continues to grow. As shown in Exhibit 1, the US leads on mentions of obesity and obesity treatment brands, with the UK following. Whereas mentions of obesity as a condition seem to have peaked, mentions of obesity brands grows dramatically between the two three-year period of Aug 2018–July 2021 and August 2021 and July 2024 – from 70% increase in France to a 716% increase in the UK. The awareness of obesity medications is increasing across all countries, regardless of whether they are available for widespread use. This, in itself, given the relentless media interest, is unsurprising; what is important, however, is the quality and maturity of the discourse and its relation to the current state of clinical reality.

Awareness of GLP-1 and associated medicines brand names is high, but the brands specifically indicated for obesity are not the most mentioned.

Obesity medication brand and molecule awareness is complicated by the legacy that GLP-1s (e.g. semaglutide) and GLP/GIPs (tirzepatide) have in the treatment of type II diabetes. The earliest GLP-1s, Byetta (exenatide) and Victoza (liraglutide) were launched in 2005 and 2010 respectively and were followed by other GLP-1 agonist for diabetes, including dulaglutide (Trulicity). Analysis of brand or generic name mentions in association with obesity for Social Media mentions (Exhibit 4, below) shows that while there are a wide variety of names mentioned, and while the newer brand name specifically indicated for obesity (Wegovy for semaglutide) are seeing very fast growth, the brand with most mentions in relation to obesity is Ozempic, the brand name for semaglutide when used for Type II diabetes, rather than obesity.

3 Worldwide trends in underweight and obesity from 1990 to 2022: a pooled analysis of 3663 population-representative studies with 222 million children, adolescents, and adults Phelps, Nowell H et al. The Lancet, Volume 403, Issue 10431, 1027 - 1050

Exhibit 4: Volume of mentions for top brands and molecules, and change.

Why should this be? Undoubtedly the intense media interest in the use of Ozempic off label by celebrities (sample headline: “The 16 celebs CONFIRMED to be on Ozempic”) and discussion of issues such as “Ozempic face” is responsible, but what’s noteworthy is that even in July 2024, three years after the June 2021 FDA approval date for Wegovy, mentions of Ozempic still eclipse those of Wegovy in relation to obesity.

This Social Media data shows there is a “perception gap” between the awareness of the general public, as measured by Social Media mentions, and current clinical realities of what medicines are approved for obesity treatment. It could be estimated that the general public perception, as expressed by Social Media mentions, is between 2 and 3 years behind the current reality of two molecules, semaglutide and tirzepatide, and three brands, Wegovy (semaglutide), and Zepbound /Mounjaro (both tirzepatide), approved specifically for obesity. For companies behind the brands which are approved for obesity, this shows just how far the Social Media narrative can diverge, and how slow it can be for entrenched public perception to change. This indicates the need to invest to build awareness of those brands – possibly a motivating factor behind Novo Nordisk’s recent (summer 2024) decision to start to invest in Direct-to-Consumer advertising in the US for Wegovy.

In conclusion, the landscape of the obesity-related drug markets is intricately influenced by Social Media dynamics. The interplay between entrenched perceptions and rapidly spreading new information highlights the necessity for pharmaceutical companies to engage actively with both HCPs and the general public through Social Media listening. Understanding and addressing perception gaps and divergences are crucial, particularly in an environment where out-of-pocket expenditures for obesity medications are high. By staying attuned to the evolving discourse, pharmaceutical companies can better align their strategies with clinical realities and patient needs, ultimately enhancing the effectiveness and acceptance of their treatments.

Recommendations for pharmaceutical companies

Obesity Social Media discourse is paradoxically both fast and slow- slow because it appears from our findings that entrenched perceptions (such as brand names associated with obesity) have long lives in Social Media discourse. Fast, because once news, whether positive or negative breaks, it can move around the world (and diverge from reality) at lightning speed. Pharmaceutical companies with current or future obesity agents cannot, however, afford to ignore it, because obesity uniquely is a prescription medicine market with a high level of out of pocket spend significantly in advance of the reimbursed medicine spend, where current and potential patients have the opportunity to be opinion formers like never before.

Engage in Active Social Media Listening

To stay attuned to the evolving discourse, pharmaceutical companies should engage in active Social Media listening. This involves monitoring conversations among both HCPs and the general public, to identify perception gaps and divergences from clinical realities. Understanding these nuances will help in crafting more effective communication strategies.

Address Entrenched Perceptions

The slow cycle of Social Media discourse on obesity is marked by deeply entrenched perceptions, particularly regarding brand names. Companies should develop targeted campaigns to address and reshape these long-standing views by providing accurate, evidence-based information to counteract misinformation, and to move the discourse along to a closer alignment with current clinical reality. This is going to be even more critical in the years to come when many more pharmacotherapies, with more diverse presentations, modalities, and claims, are on the market.

Respond Rapidly to Emerging Trends

The other cycle of Social Media is extremely fast paced, and it is crucial to monitor and respond promptly to new trends, whether positive or negative. Companies should establish rapid response processes to manage and address emergent developments, ensuring that accurate information is disseminated swiftly to mitigate the spread of misinformation.

Understanding influencers, and patients leading discourse

Patients in the obesity market drive opinion in a unique way due to the high level of out-of-pocket spending. This is not to say that patients with other conditions do not have strong perspective, expressed on Social Media, about their pharmacotherapies – they do. However, currently the majority of patients on obesity medications pay substantially or wholly out-of-pocket, and so it is those patients that are leading the discourse on experience with prescription medication. The obesity area is, of course, a magnet for Social Media influencers of all stripes, some positively engaged with an informed perspective, others very much not. It is important to be systematic on how influencers segment, how they are impacting on wider patient Social Media discourse on obesity, as well as the wider non-influencer discourse.

Educate and Inform

Pharmaceutical companies should focus on education and information dissemination to bridge the perception gaps. By providing clear, accessible information about their products and the realities of obesity treatment, companies can align public perceptions with clinical realities.

Monitor and Adapt

Continuous monitoring of Social Media trends and adapting strategies accordingly is essential. Companies should invest in robust analytics tools to track the effectiveness of their campaigns and make data-driven decisions to optimize their Social Media presence.

Social Media is an exceptionally powerful force in the development of the obesity market, because of the unusually high profile of the issue and the new pharmacotherapies in the discourse of both HCPs and the general public. This will undoubtedly continue as the obesity market evolves, with more patients and HCPs having direct experience of these pharmacotherapies, more reimbursement of pharmacotherapies, new claims from outcomes trials, and new pharmacotherapies launching. Understanding Social Media discourse will, in this fast moving and competitive world, be critical.

For more information on IQVIA Social Media Intelligence, visit https://www.iqvia.com/solutions/commercialization/brand-strategy-and-management/primary-intelligence/social-media-intelligence-for-pharma-and-consumer-health

Check out the knowledge hub for more insights on obesity.