Illuminate a path to consumer health success

Across Europe e-Pharmacy is taking hold, but in one market – Germany – consumers have adopted online shopping for OTC and other self-care products more than anywhere else. But why? Here are three reasons behind the strength of e-Pharmacy in Germany:

1. Experience and LogisticsThere is a strong cultural reason for the strength of e-Pharmacy in Germany - the country’s established history of mail-order shopping. Germans embraced mail-order shopping early, with well-established providers – such as Otto and Quelle – offering everything from fashion to homewares (see Exhibit 1), creating a culture of home delivery of products which were primarily bought in physical retail stores in other markets. These providers have moved with the times and now of course offer online shopping, with e-commerce having a high penetration and history in categories other than healthcare, bolstered by Germany’s sophisticated postal system which allows delivery of products usually within 24 hours to any domestic address.

Exhibit 1: Mail-order shopping has a long-established history in Germany (Source: IQVIA Consumer Health research, Otto, and Quelle)

2. Pharmacy Density

Added to the cultural aspect is access to pharmacy. With a population of 83million, Germany is one of the most populated countries in Europe – yet when it comes to pharmacy access, there is only one pharmacy per 4,644 people, with the number of pharmacies in Germany declining by 17% since 2012 (see Exhibit 1). This compares to Spain – where e-Pharmacy only has 4% of the country’s e-Pharmacy market – which has one pharmacy per 2,143 people and has seen the number of retail pharmacies increase by 2% since 2012.

Exhibit 2: Comparison of pharmacy density between Germany and Spain 2012-2022 (Source: IQVIA PharmaTrend)

So, with less access to retail pharmacies, the convenience of online shopping has led Germans to e-Pharmacies in ever increasing numbers, especially for non-urgent products such as weight-loss or habit control, where e-Pharmacies in Germany have a 54% and 40% share of the market respectively.

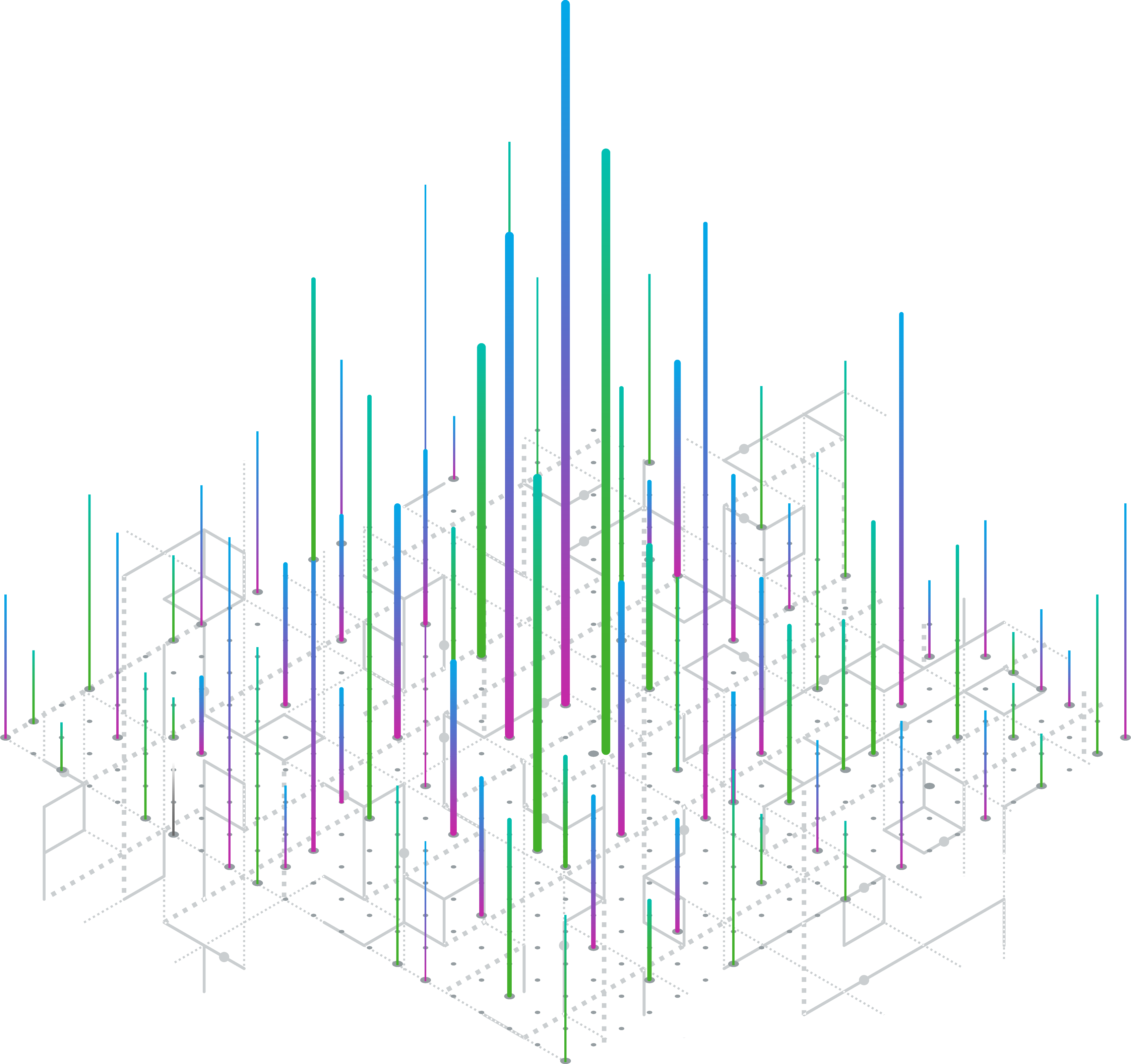

3. PriceGermany is the home of discount shopping. Discount supermarket giants Lidl and Aldi are both German firms, tapping into the populations love of value for money. e-Pharmacies take advantage of this, especially in categories which carry a higher-price point, such as circulatory support, or are bought in bigger pack sizes, such as habit control. As Exhibit 3 shows, e-Pharmacies hold a much larger share in these categories than in more ‘acute’ categories such as cough and cold, where the need is more urgent, and price becomes less of a factor vs convenience.

Exhibit 3: OTC Market (Categories 1-19+97), Pharmacy (Retail + e-Pharmacies), Sales Million €, Ranked by Share of Sales e-Pharmacies MAT 03/23 (Source: IQVIA Consumer Report Apotheke)

With maturity comes complexity

Given the maturity of the German e-Pharmacy market, the country could be seen as a harbinger of how the online pharmacy market may develop in less mature markets. A decade ago, the consumer health buying journey was quite simple. As a consumer, you went offline to a brick-and-mortar pharmacy or you went direct to an e-Pharmacy. Today all that has changed.

Exhibit 4: German consumer health shopping journeys have become more complex (Source IQVIA Consumer Health)

The journey now is much more complex (as Exhibit 4 shows) involving not only direct purchasing routes to retail and/or e-Pharmacy but layers of other services, such click and collect, price comparison sites – tapping into the German love of value for money – as well as marketplace websites such as Amazon, Google Shopping and formerly fashion-focused websites such as Zalando.

Furthermore, a number of platforms in Germany are backed by wholesalers, pharmacy cooperatives and other players to enable the brick-and-mortar pharmacies to benefit from the growing trend for online shopping.

Conclusion - Opportunities and Threats

Germans’ comfort with e-Pharmacies, combined with with the growing complexity of the online shopping journey, has led to a new opportunity and threat environment. From opportunities around reaching a wider audience, to risks around pricing and dependency on large e-retailers hitting margin, you need to be prepared for all eventualities to succeed in the German e-Commerce market (see Exhibit 5).

Exhibit 5: Business opportunities and threats in the German e-Commerce market (Source IQVIA Consumer Health)

To find out more how IQVIA Consumer Health can help your business thrive in Europe’s most mature and valuable e-Pharmacy market, do get in touch with us by clicking the CONTACT US button in this page.

Visit our Global Consumer Health Trends 2023 webpage to hear more from Thomas Heil.

Related solutions

Adapt fast, maintain momentum and stay relevant

Global Consumer Health Trends 2023 gives you expert-driven local insights on today's global challenges, so you can succeed in a dynamic, fast-changing consumer health market. Get the latest on 4 crucial market-impacting trends: consumer mindset, pricing, e-Pharmacy, and digital innovation.

Shape the future of consumer health.

See how we partner with organizations across the healthcare ecosystem, from emerging biotechnology and large pharmaceutical, to medical technology, consumer health, and more, to drive human health forward.