Grow your brand, now and through patent expiry

Starting in 2024, the Inflation Reduction Act (IRA) changed patient cost-sharing in the Catastrophic phase of coverage from a 5% coinsurance to $0. This provision effectively capped Standard Medicare patient out-of-pocket spend to around $3,300 a year where there previously had been no limit to how much patients spend on pharmaceuticals. Just a few months after the 2024 IRA changes took effect, Pfizer reported 97% growth in U.S. earnings of Vyndamax/Vyndaqel high-cost specialty cardiology medications, translating into $800 million of additional revenue. The unprecedented growth of Vyndamax/Vyndaqel may bode well for other specialty products in 2025.

A wave of new patients

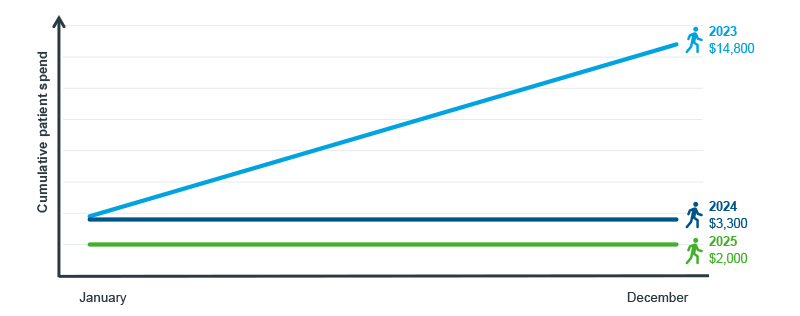

Prior to 2024, Standard Eligible patients were required to pay a 5% coinsurance in the Catastrophic phase of coverage. This meant paying out of pocket every month through the end of the year and led to high, annual expenses. The removal of Catastrophic coinsurance in 2024 put a limit on how much Part D patients would spend on pharmaceuticals, particularly benefitting patients paying for high-cost, chronic treatments. The 2024 IRA expansion of full LIS benefits further expanded the number of patients with a lower out-of-pocket benefit design. The $2,000 out-of-pocket cap in 2025 will benefit enrollees even further.

Example of cumulative patient spend in Medicare Part D with $20,000 monthly costs

Note: Standard Eligible Patients; based off of actuarial average benefit design without supplemental coverage.

Source: U.S. Market Access Strategy Consulting analysis

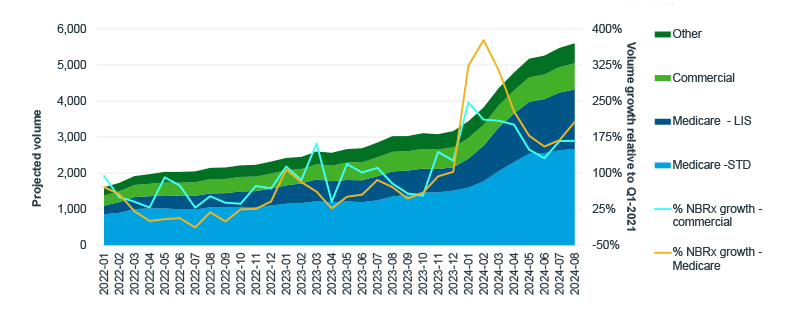

Vyndamax and Vyndaqel are two forms of tafamidis and have monthly list prices of over $22,000. Both brands grew slowly and steadily from their launch through 2023. In January 2024, Vyndamax and Vyndaqel volume grew more rapidly, with the number of claims increasing by 86% as of August. The sudden and sizeable increase in total claims is mostly driven by an influx of Medicare patients, with newly capped total out-of-pocket costs. Thanks to the cap, Vyndamax and Vyndaqel patients in Standard Medicare would face $3,300 annual costs in 2024 as opposed to over $14,000 in 2023.

In this analysis, new patients are believed to be newly captured instead of treatment naïve, as Patient Assistance Programs and other support solutions have historically provided chronically ill patients with high-cost therapies a means-based option in lieu of insurance. In 2024, there was a strong influx of newly captured Medicare patients, and around one-third of all Vyndamax and Vyndaqel volume was due to these newly captured patients. Standard Medicare patients were responsible for over 60% of overall growth from January through August.

Vyndamax and Vyndaqel volume and growth trends

Note: Rolling 3-month average shown; New-to-brand (NBRx) patients are considered newly captured as patients may have been receiving therapy outside of insurance before appearing in the claims data.

Source: IQVIA PlanTrak Projected Claims, U.S. Market Access Strategy Consulting analysis

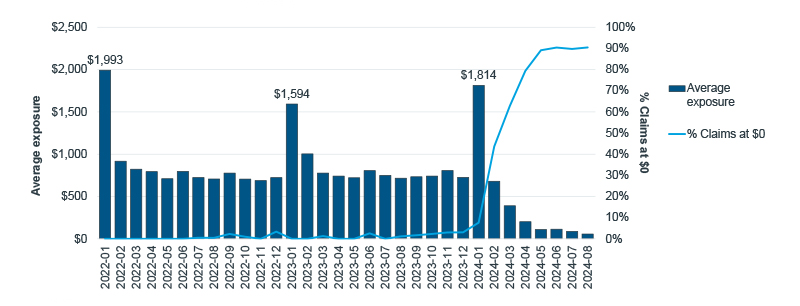

Lower costs require less financial support

Standard Medicare patients begin the year in their Deductible phase of coverage, accounting for the highest cost exposure in January for Vyndamax and Vyndaqel. Due to the high list prices of both brands, Standard Medicare patients faced average cost exposures between $700 and $900 a month in the years before $0 catastrophic cost-sharing was introduced. By March 2024, the average patient cost exposure for Vyndamax and Vyndaqel was halved to $400; by September, it had dropped to $70 – reflecting more patients entering the Catastrophic and experiencing an out-of-pocket cap. Almost no claims cost Standard Medicare patients $0 for Vyndamax or Vyndaqel prior to 2024, but by May 2024, 90% of claims cost $0.

Vyndamax and Vyndaqel patient cost exposure trends in Standard Medicare Part D

Note: Analysis limited to adjudicated claims.

Source: IQVIA LAAD 3.0 Data; U.S. Market Access Strategy Consulting analysis

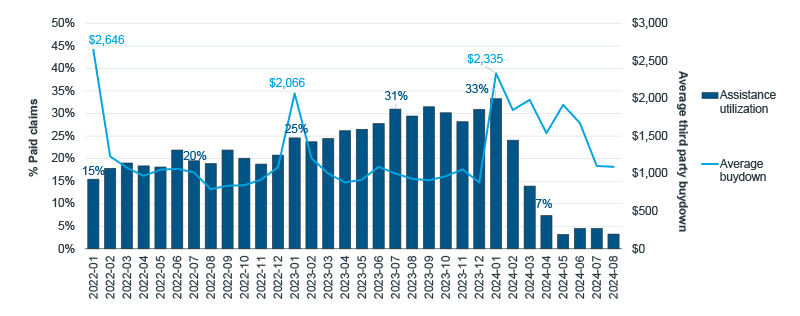

With cost exposures declining, patients' need for copay support changes. In Medicare, foundations can offset patient costs as opposed to the manufacturer-subsidized copay cards used by commercial patients. Foundation support for Vyndamax and Vyndaqel patients offset on an average of six claims prior to 2024, amounting to an annual per-patient offset of $6,500. In 2024, foundations only offset an average of one claim with an average per-patient offset of $2,400. While the per-patient cost to foundations declined, utilization increased from 32% of Vyndaqel and Vyndamax patients in 2023 to 44% in 2024. The proportion of Medicare claims that used foundations to offset costs also declined as the year progressed and patients entered the Catastrophic phase with $0 cost-sharing. As out-of-pocket caps cut back the annual patient spending on specialty drugs like Vyndamax and Vyndaqel, foundations and other programs that have historically made such medicines affordable to seniors might now have the resources available to help even more patients.

Co-pay support utilization and buydown trends for Vyndamax and Vyndaqel in Standard Medicare Part D

Note: Analysis limited to adjudicated claims.

Source: IQVIA LAAD 3.0 Data; U.S. Market Access Strategy Consulting analysis

A sign of what’s to come

Vyndamax and Vyndaqel volume trends accelerated as early as January 2024. By the third quarter of 2024, multiple managed care organizations (MCOs) reported meaningful increases in overall specialty drug utilization trends. Though not all MCOs attributed the increases to the IRA and $0 catastrophic cost-sharing, at least one – United Health Group – had stated its explicit role. But MCOs are not the only organizations impacted by the policy. Manufacturers, too, noted increased sales for specialty medications. Bristol Myers Squibb and Merck reported 15% and 13% increases in sales for their oral oncologic drugs Pomalyst and Lynparza, respectively, in the third quarter of 2024 compared to 2023. For the same time period, Pfizer reported between 28% and 77% growth in revenue across all of its oral oncology medications, along with the growth of Vyndamax and Vyndaqel.

As the threshold to enter Catastrophic coverage decreases to $2,000 in 2025, Medicare patients will experience lower costs overall and earlier in the year. Affording high-cost medications will become an achievable reality for many more Medicare patients. This will not only bring a wave of patients willing and able to fill their medications, but lower patient exposures also allow for assistance programs to spread their funding further to help more patients. The lessons of Vyndamax and Vyndaqel in 2024 should serve as a prototype for what is to come when even more changes launch in 2025.

The Upside of the IRA: $0 Catastrophic Cost-Sharing and Patient Benefits

The Inflation Reduction Act (IRA) of 2022 has reshaped patient costs by capping expenses for vaccines and insulins, and eliminating cost-sharing in the Catastrophic phase of Medicare Part D. This blog explores the impact of these changes on patient behavior and spending, and previews further reductions in 2025.

Related solutions

Gain high value access and increase the profitability of your brands