Take advantage of the latest tools, techniques, and deep healthcare expertise to create scalable resources, precision insights, and actionable ideas.

The previous articles in this series examined value trends across six major therapy areas. Branded originators naturally dominate the market by value, whilst generics and biosimilars constitute the majority of volume. This fourth and final article therefore explores the generics and biosimilars sectors, investigating the volume dynamics within particular indications at both a product and country level.

Generics account for a large and slowly increasing percentage of each therapy area by volume, except oncology

Generics generally comprise around 80% of each major therapy area by volume, illustrated in Figure 1, with the originators making up the remaining 20%. For most therapy areas, the generic market shares by volume have been slowly increasing over recent years; the exception to this is oncology. Oncology is also the outlier in terms of generics’ share of the market by value: this was just 12% in 2022, which reflects the high cost of many innovative oncology therapies.

Figure 1: generics’ share of the global market for six therapy areas, by volume in 2018 and 2022, and by value in 2022

Source: IQVIA MIDAS Disease. Biologics have been excluded. Volume is measured in standard units, and sales are ex-manufacturer, calculated using a constant exchange rate. Disease area groupings are as in MIDAS Disease, apart from respiratory, where cystic fibrosis has been excluded, and immunology, which was created manually. Diseases and products which are unclassified in MIDAS Disease have been excluded.

Seretide volume is falling for asthma and COPD in the EU4, UK and US, but remains greater than that of all its generics combined

The combination inhaler Seretide (salmeterol xinafoate and fluticasone propionate) lost exclusivity in the US in 2010, and in Europe in 2013. Figure 2 shows the units of Seretide and its generics dispensed in the EU4, UK and US for asthma and COPD: Seretide volumes have fallen in recent years, but at a decreasing rate. In the last year, Seretide volume dropped by just 4% in these indications and countries, and remains greater than that of all its generics combined. Sirdupla is the leading branded generic product in this market, although its volume has been falling since 2020, during which time new generics have launched.

Figure 2: volume of Seretide and its generics for asthma and COPD in the EU4, UK and US (2018-23 Q2 MAT)

Source: IQVIA MIDAS Disease. The volumes are for asthma and COPD only. MAT includes data from Q3 of the previous year up to Q2 of the labelled year.

In the global rheumatoid arthritis and psoriatic arthritis markets, Humira, Enbrel and Remicade dominate over their biosimilars in terms of volume

The three biologics Humira, Enbrel and Remicade (adalimumab, etanercept and infliximab respectively) lost patent protection several years ago in Europe, and biosimilars have entered the market for each. However, in the US, while Remicade biosimilars entered the market in 2016, Humira’s patent only expired in early 2023, and Enbrel will not lose exclusivity until 2029.

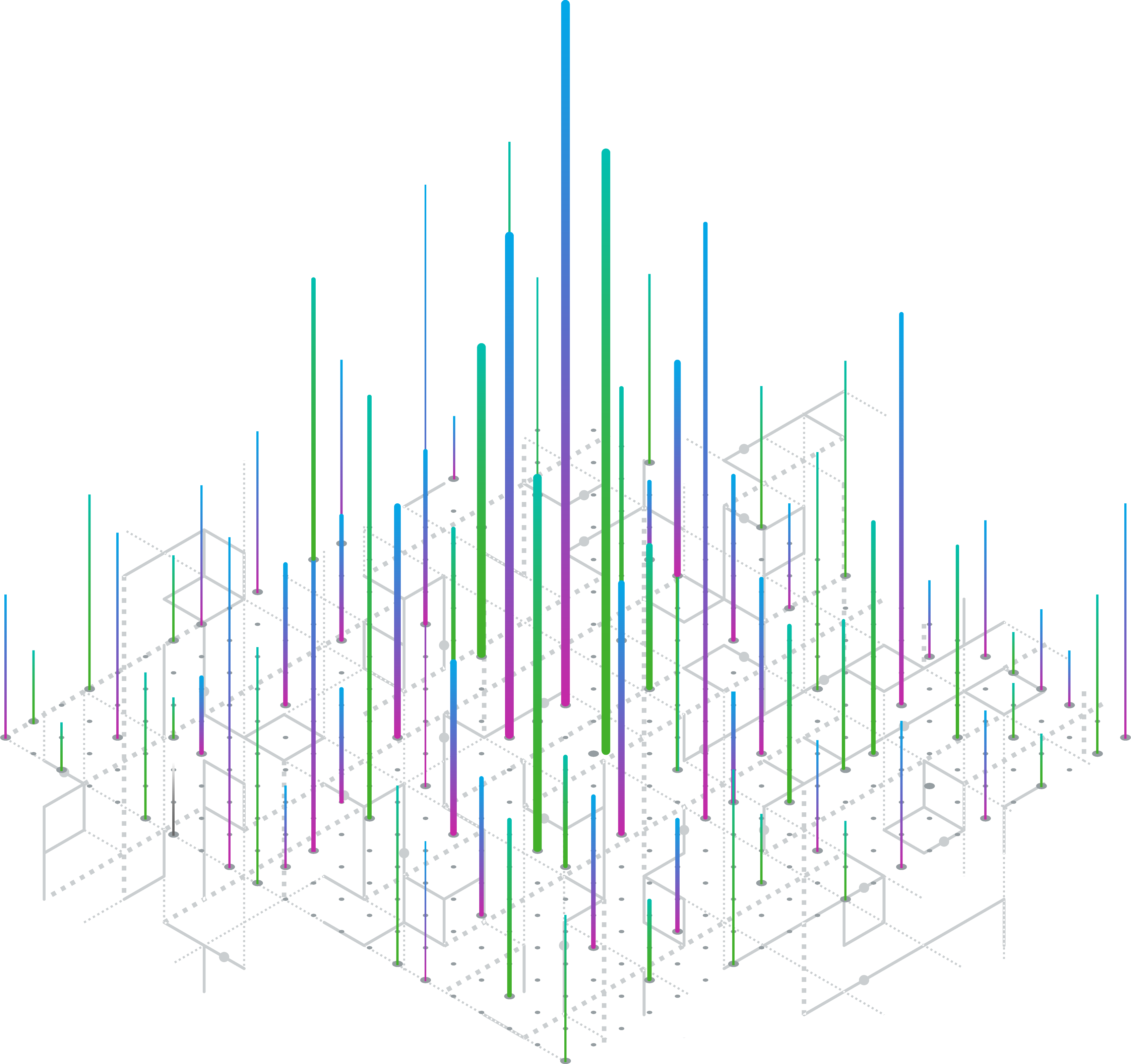

Rheumatoid arthritis (RA) and psoriatic arthritis (PsA) were among the top five indications for each of these biologics in 2022, in volume terms. The relative global market shares of Humira, Enbrel, Remicade and their biosimilars for these two indications are shown in Figure 3. For RA, Humira and Enbrel both have significantly larger volumes than their respective biosimilars, whereas for PsA, the split is more even. Remicade biosimilars are almost equal in volume to Remicade for both indications. For all three biologics, biosimilars account for increasingly large volume shares each year across both indications, compared to their respective originators.

Figure 3: relative global volume shares of Humira, Enbrel, Remicade and their biosimilars for rheumatoid arthritis and psoriatic arthritis in 2022

Source: IQVIA MIDAS Disease. Volume is measured in standard units.

Amgevita became the leading adalimumab product in 2022 for psoriatic arthritis in the EU4&UK, ahead of Humira, as measured in standard units

In the EU4&UK, adalimumab biosimilars entered the market in 2018 and have grown steadily in volume since then. For PsA, Humira accounted for only 24% of total adalimumab volume in 2022, and its volume is falling by 15% year-on year (YOY), while its biosimilars have increased in volume each year. Figure 4 depicts these trends at a product level.

Figure 4: Trends in volume of adalimumab products in the psoriatic arthritis market in the EU4&UK:

(a) Humira and the top 2 adalimumab biosimilars; (b) the top 5 adalimumab biosimilars

Source: IQVIA MIDAS Disease. In both line charts, the volume of each product is its volume within the psoriatic arthritis market only.

Amgevita has consistently led adalimumab biosimilars for PsA in the EU4&UK by volume; it grew at a rate of 10% YOY from 2021-2022, and overtook Humira in 2022. By contrast, Imraldi volume has now plateaued, despite its notable launch in this market. Hyrimoz and Idacio are currently driving absolute volume growth, with YOY volume growth rates of 35% and 122% respectively. This market is clearly competitive, further exemplified by recent EMA approvals of additional adalimumab biosimilars for PsA, such as Yuflyma.

Uptake of infliximab biosimilars for Crohn’s disease varies significantly between major developed countries

Figure 5 illustrates the relative shares of Remicade and its biosimilars by volume for Crohn’s disease – infliximab’s top indication – across five major geographies. The variation is striking: in the EU4 and UK, biosimilars heavily dominate over Remicade. In the US, there is an even split, whilst in Japan and China, Remicade volume is far greater than that of its biosimilars. This may partly be accounted for by the range in biosimilar launch dates. Remicade biosimilars were among the first monoclonal antibodies to launch, and have now been present in Europe, Japan and the US for the best part of a decade (since 2013, 2014 and 2016 respectively), whereas in China, Remicade biosimilars entered the market at the end of 2021.

Figure 5: relative shares of Remicade and its biosimilars for Crohn’s disease in five major markets by volume (standard units – thousands)

Source: IQVIA MIDAS Disease. Infliximab volume is measured in standard units (thousands) and is the volume within the Crohn’s disease market only.

However, the extent of the variation in Figure 5 suggests that there are multiple contributing factors, with room for biosimilar uptake to increase in many countries. These factors likely include challenges around pricing and reimbursement: a biosimilar must undercut the originator in cost significantly enough to financially incentivise the switch. In addition, to achieve high biosimilar uptake, healthcare systems must be ready for and prioritise the transition to biosimilars. In order to introduce a high level of competition for biosimilars, it is necessary to educate stakeholders, policy makers and physicians on the current gold standard of uptake in other markets, and reassure patients.

Understanding market dynamics at the disease level is a strategic advantage, especially with the rising number of multi-indicational products

The pharmaceutical market is becoming increasingly sophisticated: novel, innovative products for all therapy areas are entering the market, and the generics and biosimilars sectors are also seeing many new launches. Crucially, many drugs are expanding to multiple indications, making it ever more important to break the data down by indication and understand the different dynamics within each individual market.

This understanding of markets and trends at the disease level enables enhanced forecasting precision, as well as comprehensive competitor analysis, with the ability to assess the uptake and performance of a competitor’s product across different indications. Finally, as the market fragments and opportunities for launching novel products become more scarce, disease splits give insight into under-served markets and therefore other areas of opportunity. In these ways, the disease-level data offered by MIDAS Disease can play a major role in achieving a full understanding of the current market, optimally positioning products, and making well-informed, strategic decisions.

To access additional resources about MIDAS Disease, such as fact sheets, on-demand webinar, blog articles and to inquire about a demo, please click here.

Related solutions

Be proactive about growing your brand using the latest in data, analytics, and domain expertise.

Get an up to date view of key performance indicators globally, regionally, or locally.

Analyze industry leading sales and medical data in a standardized and comparable way, including cross-country analysis of performance and additional insights into global and regional markets.