-

Americas

-

Asia & Oceania

-

A-I

J-Z

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more -

Middle East & Africa

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more

Regions

-

Americas

-

Asia & Oceania

-

Europe

-

Middle East & Africa

-

Americas

-

Asia & Oceania

-

Europe

Europe

- Adriatic

- Belgium

- Bulgaria

- Czech Republic

- Deutschland

- España

- France

- Greece

- Hungary

- Ireland

- Israel

- Italia

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more -

Middle East & Africa

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more

SOLUTIONS

-

Research & Development

-

Real World Evidence

-

Commercialization

-

Safety & Regulatory Compliance

-

Technologies

LIFE SCIENCE SEGMENTS

HEALTHCARE SEGMENTS

- Information Partner Services

- Financial Institutions

- Global Health

- Government

- Patient Associations

- Payers

- Providers

THERAPEUTIC AREAS

- Cardiovascular

- Cell and Gene Therapy

- Central Nervous System

- GI & Hepatology

- Infectious Diseases and Vaccines

- Oncology & Hematology

- Pediatrics

- Rare Diseases

- View All

Impacting People's Lives

"We strive to help improve outcomes and create a healthier, more sustainable world for people everywhere.

LEARN MORE

Harness the power to transform clinical development

Reimagine clinical development by intelligently connecting data, technology, and analytics to optimize your trials. The result? Faster decision making and reduced risk so you can deliver life-changing therapies faster.

Research & Development OverviewResearch & Development Quick Links

Real World Evidence. Real Confidence. Real Results.

Generate and disseminate evidence that answers crucial clinical, regulatory and commercial questions, enabling you to drive smarter decisions and meet your stakeholder needs with confidence.

REAL WORLD EVIDENCE OVERVIEWReal World Evidence Quick Links

See markets more clearly. Opportunities more often.

Elevate commercial models with precision and speed using AI-driven analytics and technology that illuminate hidden insights in data.

COMMERCIALIZATION OVERVIEWCommercialization Quick Links

Service driven. Tech-enabled. Integrated compliance.

Orchestrate your success across the complete compliance lifecycle with best-in-class services and solutions for safety, regulatory, quality and medical information.

COMPLIANCE OVERVIEWSafety & Regulatory Compliance Quick Links

Intelligence that transforms life sciences end-to-end.

When your destination is a healthier world, making intelligent connections between data, technology, and services is your roadmap.

TECHNOLOGIES OVERVIEWTechnology Quick Links

CLINICAL PRODUCTS

COMMERCIAL PRODUCTS

COMPLIANCE, SAFETY, REG PRODUCTS

BLOGS, WHITE PAPERS & CASE STUDIES

Explore our library of insights, thought leadership, and the latest topics & trends in healthcare.

DISCOVER INSIGHTSTHE IQVIA INSTITUTE

An in-depth exploration of the global healthcare ecosystem with timely research, insightful analysis, and scientific expertise.

SEE LATEST REPORTSFEATURED INNOVATIONS

-

IQVIA Connected Intelligence™

-

IQVIA Healthcare-grade AI®

-

-

Human Data Science Cloud

-

IQVIA Innovation Hub

-

Decentralized Trials

-

Patient Experience Solutions with Apple devices

WHO WE ARE

- Our Story

- Our Impact

- Commitment to Global Health

- Code of Conduct

- Sustainability

- Privacy

- Executive Team

NEWS & RESOURCES

Unlock your potential to drive healthcare forward

By making intelligent connections between your needs, our capabilities, and the healthcare ecosystem, we can help you be more agile, accelerate results, and improve patient outcomes.

LEARN MORE

IQVIA AI is Healthcare-grade AI

Building on a rich history of developing AI for healthcare, IQVIA AI connects the right data, technology, and expertise to address the unique needs of healthcare. It's what we call Healthcare-grade AI.

LEARN MORE

Your healthcare data deserves more than just a cloud.

The IQVIA Human Data Science Cloud is our unique capability designed to enable healthcare-grade analytics, tools, and data management solutions to deliver fit-for-purpose global data at scale.

LEARN MORE

Innovations make an impact when bold ideas meet powerful partnerships

The IQVIA Innovation Hub connects start-ups with the extensive IQVIA network of assets, resources, clients, and partners. Together, we can help lead the future of healthcare with the extensive IQVIA network of assets, resources, clients, and partners.

LEARN MORE

Proven, faster DCT solutions

IQVIA Decentralized Trials deliver purpose-built clinical services and technologies that engage the right patients wherever they are. Our hybrid and fully virtual solutions have been used more than any others.

LEARN MORE

IQVIA Patient Experience Solutions with Apple devices

Empowering patients to personalize their healthcare and connecting them to caregivers has the potential to change the care delivery paradigm.

LEARN MOREIQVIA Careers

Featured Careers

Stay Connected

WE'RE HIRING

"At IQVIA your potential has no limits. We thrive on bold ideas and fearless innovation. Join us in reimagining what’s possible.

VIEW ROLES- Blogs

- Top Five Insights from the IQVIA Institute 2019 Oncology Trends Report

Our Global Oncology Trends 2019 report is officially released, and it details the trends shaping the development and delivery of cancer treatment worldwide.

I’d like to share with you five key insights from the report. For all of the detailed, data-driven insights, download the full report and explore the trends influencing clinical development in oncology treatments today and through 2023.

- Immunotherapies are rapidly being adopted as first-line treatments

- Precision medicine and biomarkers increase trial complexity

- Spending growth continues in double digits

- Time to approval is decreasing, but delivery remains a barrier

- Trial productivity is key in this high risk, high reward therapy area

Cancer patients today have more and better treatment options than ever, with improvements in progression-free survival and new options for relapsed or refractory cancers. Immuno-oncology therapies account for many of the new options and have in just 2-3 years become first-line oncology treatments (see exhibit).

These treatments now account for more than three-quarters of all lines of therapy in metastatic melanoma.

Similarly, treatment for breast cancer, the most prevalent cancer among women, has been transformed with the introduction and rapid uptake of new options, particularly CDK4/6 inhibitors. The number of patients treated with these drugs nearly tripled in the top five European countries in the past year, now matching similar rates of use in the U.S.

Precision medicines stratify patients according to their biomarkers into those most likely to respond to therapy, for both trials and treatment. Predictive biomarkers were associated with 60% of new treatments, and three were approved with a companion diagnostic.

Biomarker testing for trials is becoming easier and more widely available, improving the selection of trial participants. Nonetheless, trial complexity may increase as novel trial designs are enabled (i.e. large basket trials with multiple arms) and as sponsors become reliant on molecular profiling companies for data.

Driving the increase in health-system spending is not only the use of new treatments, but also the use of available treatments in more patients and for longer treatment durations. Spending levels and growth rates are higher across most parts of the world, and this is expected to continue for at least the next five years. New and protected brands account for nearly all the growth in spending.

Spending on cancer drugs in the U.S. has more than doubled since 2013 and reached almost $57 billion in 2018. Outside the U.S., oncology costs exceeded $66 billion in 2018, driven by new product launches and increased volume use of existing brands.

New oncology drugs launched in 2018 went from patent filing to approval four years more quickly than drugs launched in 2017. But more than half of new cancer treatments are available only within a select nine countries, and novel therapies such as CAR-T require capabilities that are rare even in the U.S.

For example, CAR-T cancer treatments require that centers be competent to collect T cells and reintroduce them to the patient. Few cancer centers have achieved accreditation, and these centers can be thousands of miles away from a patient. In France, a 2016 study found that only eight hospitals, treating 11% of patients, met the criteria (see exhibit).

The difficulties in accessing these new treatments can place logistical and financial burdens on families and caregivers. However, because treatment time can be shorter, the total burden doesn’t necessarily increase but is borne over a shorter time period.

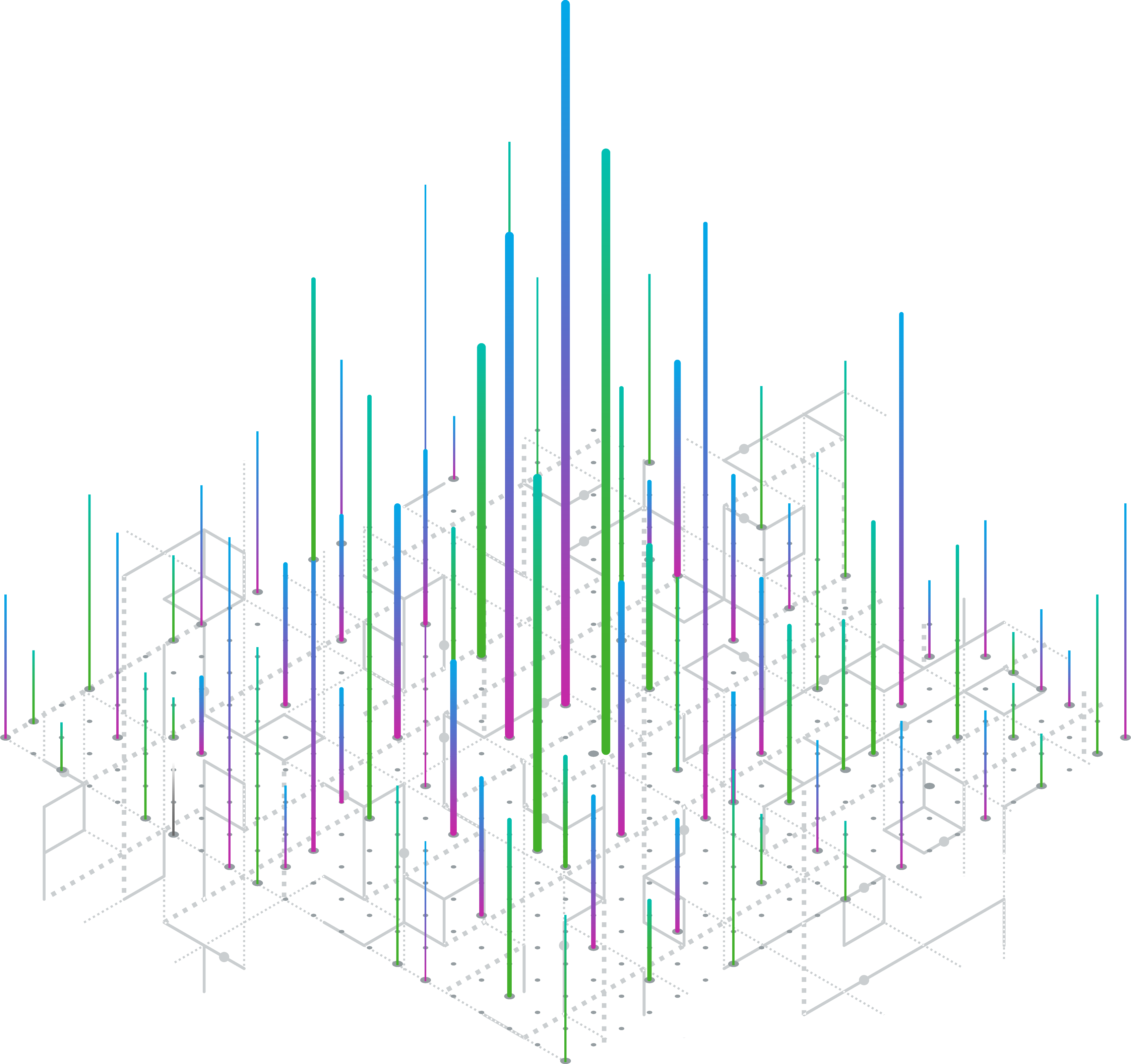

Overall productivity of oncology trials has improved since 2000 by 22% but remains far lower than trials for other therapy areas. Researchers are improving the productivity of trials by identifying participants from pools of pre-screened patients, which could improve productivity 104% by 2023. The use of biomarker tests is projected to yield a 71% improvement.

The following exhibit shows the possible impact of the top eight oncology trends on trial productivity over the next five years. The likely impact of each trend is detailed in the full report.

A closer look at oncology trends

The full report – Global Oncology Trends 2019 – is rich with data and exhibits illuminating the trends influencing clinical development in oncology treatments today and through 2023, including scientific advances in therapeutics, shifts in therapy use, trial productivity and success rates, as well as changes in spending patterns. I invite you to download it today, along with the full set of exhibits you can reference in your own work.