About the Report

The remarkable advances in basic science combined with improvements in translational science and approaches to clinical development have resulted in record levels of novel medicines reaching patients in recent years. While the COVID-19 pandemic has caused disruption of clinical trial activity with expected delays in trial programs and subsequent filings and launches, the pandemic has simultaneously unleashed a flurry of new innovations.

It has also prompted unprecedented collaboration and decisions by regulatory authorities to adapt review and approval processes. For example, the expanded adoption of approaches driven by data, analytics, and technology - such as the use of home health patient services and connected devices, direct to patient delivery of lab tests and trial drugs, remote data monitoring, and virtual study support services for sites - are enabling clinical research to continue in some instances.

Longer-term, COVID-19 will provide an opportunity to learn as Human Data Science paves the way for new and different approaches to research and human health. There will likely be a general uplift in discovery and R&D leading to new breakthroughs in novel therapies and vaccines, particularly in infectious diseases, which are likely to remain an area of focus. The elevated agility and urgency toward R&D in infectious diseases by regulators, investigators, study sponsors and supporting service providers will have a halo effect on pharmaceutical and regulatory innovation across all critically important disease areas.

Report Summary

This report assesses the current status in the R&D of medicines at the end of 2019. It provides an analysis of the number of initiated clinical trials and insight into the success rate of products as they more through phases of development. The current state of innovation is explored by examining the record numbers of new active substances (NAS) launched in 2019, analyzing their features and development path, as well as the significant contributions of both NAS and non-NAS therapies.

As levels of life science venture capital activity and large pharma R&D spend continue to grow, this report also investigates the expanding pipeline of therapies still under development, examines trends among therapy areas, and analyzes the growing number of Next- Generation Biotherapeutic products, which include cell, gene, and nucleotide therapies.

Key Findings

New Product Launches

The cohort of 50 new drugs launched in 2019 are being impacted by COVID-19 in terms of the awareness, education and patient use of these novel medicines. Engagement with healthcare professionals to make them aware and educate them about these new drugs is being transitioned from in-person to virtual interactions.

Attributes of Pivotal and Accelerated Approval Requirement Trials for 2019 NAS with Accelerated Approval

On average, 40 new active substances (NAS) in the United States were launched per year over the time period of 2009 through 2019. In 2019, 50 NAS reached patients, down slightly from 59 in 2018, but higher than the historical average. However, development time has not shifted significantly despite an increased number of specialty drugs and orphan indications among NAS in 2019, with the median development time from first patent filing to launch being 13.7 years for NAS products in 2019.

The overall percentage of NAS receiving expedited approval has increased steadily since 2015, and in 2019, 37 NAS products (74%) had at least one expedited review designation. On average, post-marketing requirements for accelerated approvals included more than three times the number of subjects and six times the number of patient years. In addition, 40% of NAS launches in 2019 were identified by the FDA as first-in-class – drugs noted by the FDA as innovative therapies with mechanisms of action different from those of existing therapies – almost double the number in 2011.

Advances in patient care also occurred around new and expanded uses of currently approved products in 2019, with notable examples in infectious disease, cardiovascular/metabolic, oncology, and central nervous system disorders, expanding access to new patient populations and improving patient value through simplified dosing or formulation.

Investments

Venture capital investments in early stage innovation companies may be impacted due to delays in decision-making and reassessment of capital markets, but investors appear to remain committed to their life sciences investment thesis.

U.S. Life Science Venture Capital Deal Value in US$Bn and Number of Deals Closed by Type, 2006-2019

Life science venture capital deal activity topped $20 billion in 2019 with average deal values growing at a five-year CAGR of 12%. Approximately a third of the deals were in the angel investor and seed funding category, up from 18% of deals in 2009, demonstrating a shift in the mix of venture capital life science deals from later to earlier stages of development. Large pharma R&D spending grew 26% over the past five years, topping over 100 billion for the second year in a row, although expenditure was up only modestly in 2019 over 2018 levels.

Clinical Trial Activity

We have seen the rapid initiation of clinical trials for COVID-19 vaccines and therapeutics around the world. The clinical research community has worked together to accelerate the design, planning, and implementation of these research programs.

Number of Clinical Trials with Pharmacogenomic Biomarkers in Total and by Select Therapy Areas, 2010-2019

The number of clinical trials increased with a CAGR of 5.8% from 2014 to 2019, however, the overall number of clinical trials initiated in 2019 did not increase significantly over 2018, due in part to a modest decrease in the number of initiated Phase III trials. The number of clinical trials tagged as having pharmacogenomic (PGX) patient preselection/stratification–those trials that constitute precision medicines–have increased over 50% since 2014 to a total of 972 trials. The percent of trials that include a predictive biomarker increased only modestly from 14% to 17% over 10 years, indicating challenges remain both in identifying novel biomarkers and testing them in clinical development. The composite success rate, which describes the likelihood of bringing a drug candidate through regulatory approval, fell from 11.1% in 2018 to 7.6% in 2019, well below the average of 12.9% for the period of 2009-2019, due to drops in success across all development stages.

New Product Pipeline

The pharmaceutical and healthcare communities have quickly mobilized to leverage both existing resources and to implement novel processes to explore and develop both symptomatic treatments and vaccines for COVID-19.

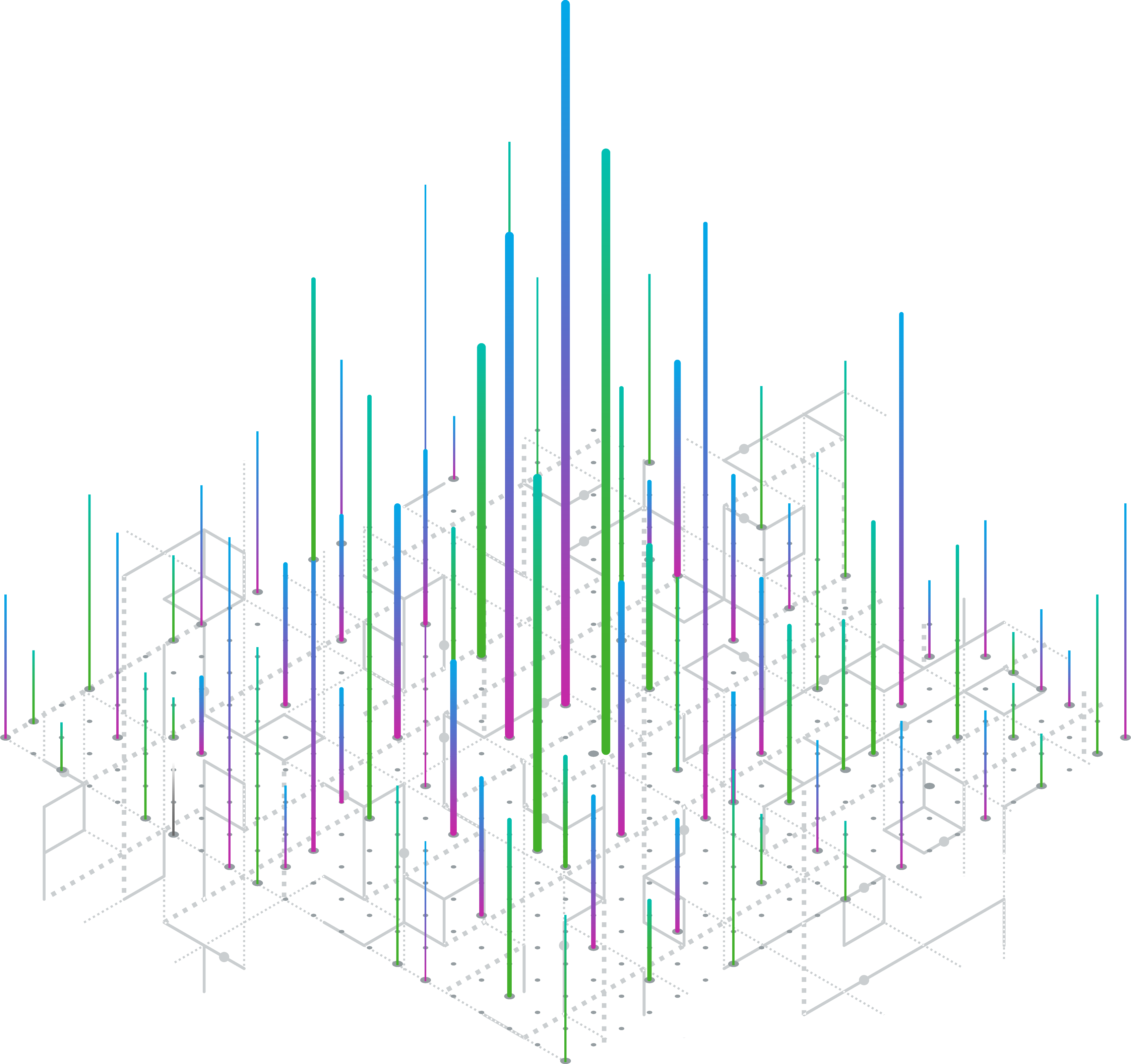

Next-Generation Biotherapeutics Pipeline by Phase and Therapy Area Percentage of Total

The late-stage active pipeline has grown 50% since 2014, reflecting a continued push for therapies in oncology, infectious disease, and neurology. Overall, the total late-stage pipeline now comprises 3,169 products with a growth of 10% from 2018 and a CAGR of 8% over the past five years. Of noe, Next-Generation Biotherapeutics (NGB), defined as cell, gene, and nucleotide therapies, now make up nearly 12% of the late-stage pipeline.

There has been a 76% increase in oncology products in the late-stage pipeline over the past five years, and in 2019, oncology products account for 30% of the late-stage pipeline. The gastrointestinal pipeline has seen a significant increase in NASH products, growing from 10 products in 2014 to 45 in 2019, and the number of gastrointestinal therapies in the late-stage pipeline have grown 73% in the past five years and represent 7% of the 2019 late-stage pipeline. Infectious disease represents 6% of the 2019 late-state active pipeline, growing 13% over the past five years.