-

Americas

-

Asia & Oceania

-

A-I

J-Z

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more -

Middle East & Africa

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more

Regions

-

Americas

-

Asia & Oceania

-

Europe

-

Middle East & Africa

-

Americas

-

Asia & Oceania

-

Europe

Europe

- Adriatic

- Belgium

- Bulgaria

- Czech Republic

- Deutschland

- España

- France

- Greece

- Hungary

- Ireland

- Israel

- Italia

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more -

Middle East & Africa

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more

SOLUTIONS

-

Research & Development

-

Real World Evidence

-

Commercialization

-

Safety & Regulatory Compliance

-

Technologies

LIFE SCIENCE SEGMENTS

HEALTHCARE SEGMENTS

- Information Partner Services

- Financial Institutions

- Global Health

- Government

- Patient Associations

- Payers

- Providers

THERAPEUTIC AREAS

- Cardiovascular

- Cell and Gene Therapy

- Central Nervous System

- GI & Hepatology

- Infectious Diseases and Vaccines

- Oncology & Hematology

- Pediatrics

- Rare Diseases

- View All

Impacting People's Lives

"We strive to help improve outcomes and create a healthier, more sustainable world for people everywhere.

LEARN MORE

Harness the power to transform clinical development

Reimagine clinical development by intelligently connecting data, technology, and analytics to optimize your trials. The result? Faster decision making and reduced risk so you can deliver life-changing therapies faster.

Research & Development OverviewResearch & Development Quick Links

Real World Evidence. Real Confidence. Real Results.

Generate and disseminate evidence that answers crucial clinical, regulatory and commercial questions, enabling you to drive smarter decisions and meet your stakeholder needs with confidence.

REAL WORLD EVIDENCE OVERVIEWReal World Evidence Quick Links

See markets more clearly. Opportunities more often.

Elevate commercial models with precision and speed using AI-driven analytics and technology that illuminate hidden insights in data.

COMMERCIALIZATION OVERVIEWCommercialization Quick Links

Service driven. Tech-enabled. Integrated compliance.

Orchestrate your success across the complete compliance lifecycle with best-in-class services and solutions for safety, regulatory, quality and medical information.

COMPLIANCE OVERVIEWSafety & Regulatory Compliance Quick Links

Intelligence that transforms life sciences end-to-end.

When your destination is a healthier world, making intelligent connections between data, technology, and services is your roadmap.

TECHNOLOGIES OVERVIEWTechnology Quick Links

CLINICAL PRODUCTS

COMMERCIAL PRODUCTS

COMPLIANCE, SAFETY, REG PRODUCTS

BLOGS, WHITE PAPERS & CASE STUDIES

Explore our library of insights, thought leadership, and the latest topics & trends in healthcare.

DISCOVER INSIGHTSTHE IQVIA INSTITUTE

An in-depth exploration of the global healthcare ecosystem with timely research, insightful analysis, and scientific expertise.

SEE LATEST REPORTSFEATURED INNOVATIONS

-

IQVIA Connected Intelligence™

-

IQVIA Healthcare-grade AI®

-

IQVIA AI Assistant

-

Human Data Science Cloud

-

IQVIA Innovation Hub

-

Decentralized Trials

-

Patient Experience Solutions with Apple devices

WHO WE ARE

- Our Story

- Our Impact

- Commitment to Global Health

- Code of Conduct

- Sustainability

- Privacy

- Executive Team

NEWS & RESOURCES

Unlock your potential to drive healthcare forward

By making intelligent connections between your needs, our capabilities, and the healthcare ecosystem, we can help you be more agile, accelerate results, and improve patient outcomes.

LEARN MORE

IQVIA AI is Healthcare-grade AI

Building on a rich history of developing AI for healthcare, IQVIA AI connects the right data, technology, and expertise to address the unique needs of healthcare. It's what we call Healthcare-grade AI.

LEARN MORE

Meet the IQVIA AI Assistant

Your new expert analyst is here. Be at the forefront of data-driven decision-making with a new generative AI tool that enables you to interact with our products and solutions like never before. Get results you can trust, faster.

LEARN MORE

Your healthcare data deserves more than just a cloud.

The IQVIA Human Data Science Cloud is our unique capability designed to enable healthcare-grade analytics, tools, and data management solutions to deliver fit-for-purpose global data at scale.

LEARN MORE

Innovations make an impact when bold ideas meet powerful partnerships

The IQVIA Innovation Hub connects start-ups with the extensive IQVIA network of assets, resources, clients, and partners. Together, we can help lead the future of healthcare with the extensive IQVIA network of assets, resources, clients, and partners.

LEARN MORE

Proven, faster DCT solutions

IQVIA Decentralized Trials deliver purpose-built clinical services and technologies that engage the right patients wherever they are. Our hybrid and fully virtual solutions have been used more than any others.

LEARN MORE

IQVIA Patient Experience Solutions with Apple devices

Empowering patients to personalize their healthcare and connecting them to caregivers has the potential to change the care delivery paradigm.

LEARN MOREIQVIA Careers

Featured Careers

Stay Connected

WE'RE HIRING

"At IQVIA your potential has no limits. We thrive on bold ideas and fearless innovation. Join us in reimagining what’s possible.

VIEW ROLES- Blogs

- Channel Impact: can virtual contacts really pick up the slack?

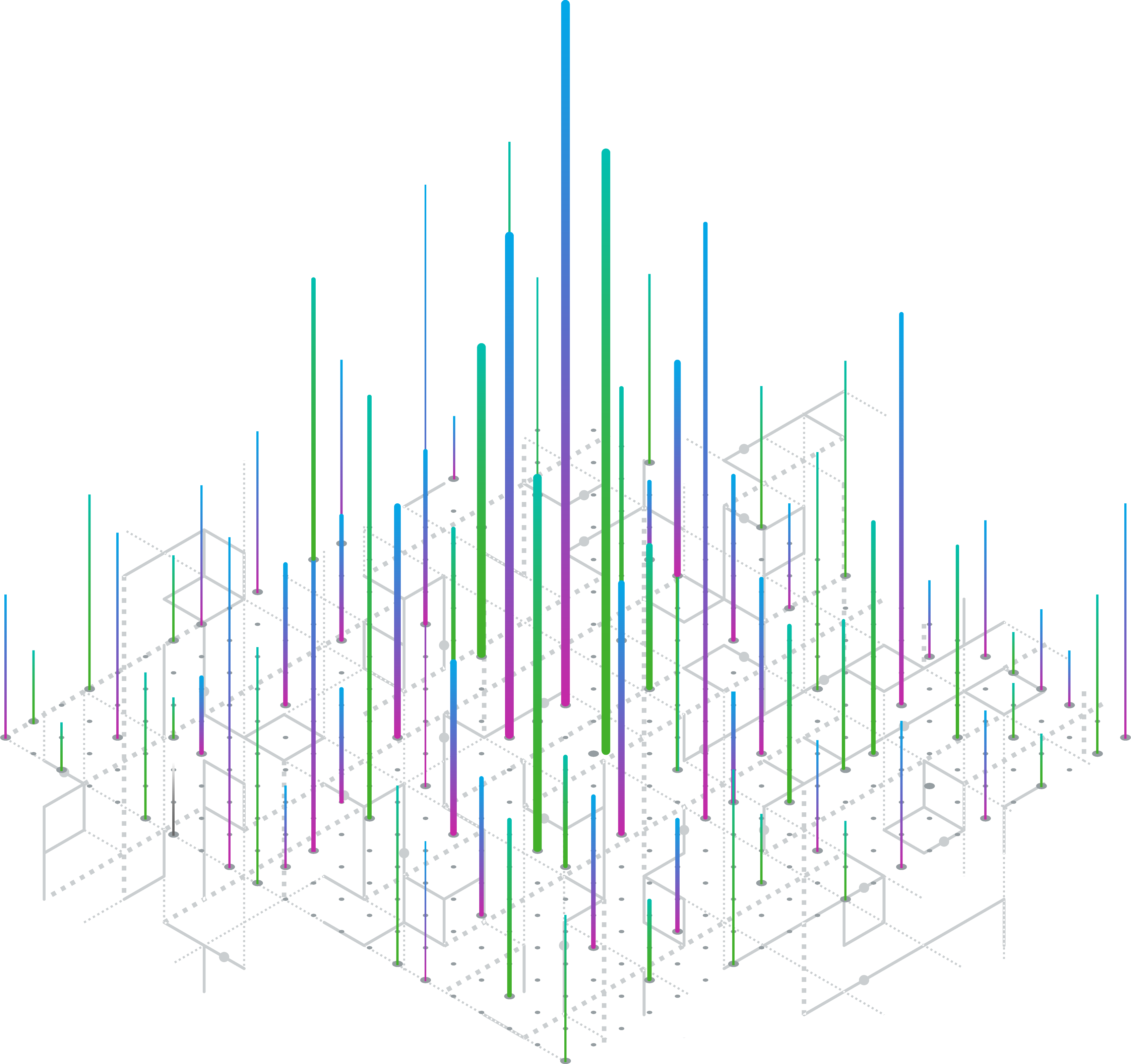

Prior to 2020, face to face (F2F) detailing was the central pillar of pharma communication with HCPs and, while recent years had seen some movement towards a more orchestrated multichannel approach, remained the main channel for raising awareness and driving uptake of new products. The restrictions on F2F contacts imposed by the COVID-19 pandemic triggered an explosion in the volume of live e-detailing and telephone detailing, as the only alternatives to maintaining interactive contact between reps and physicians. However, adoption of these channels, live e-detailing in particular, had been so low that even the 10 to 20 fold increases in volume use seen in some countries were not sufficient to fully compensate for the time with HCPs lost from F2F (Figure 1). Looking across major geographies (US, Japan, China, EU5), only the US came close to maintaining the previous year's level of interactive contact time. Although Japan was able to maintain, and even surpass 2019 levels of total contact time, that was largely through the use of non-interactive, automated e-detailing (not shown in the chart below). In terms of interactive time, Japan faired as poorly as Europe.

Disruption to F2F contacts is likely to continue well into 2021, as vaccine roll out timelines will dictate easing of social distancing measures, and welcoming reps back into healthcare facilities may not be a priority. Beyond 2021, doctors could have less time to see reps F2F as they seek to address the non-COVID treatment backlog and may simply have lost the habit or gained a preference for remote engagement. Inevitably, remote interactive channels will continue to feature more prominently in the commercial model of the future. In light of this new reality, one big question remains: will this new promotional mix and, more specifically, remote detailing channels, be as effective as the previous F2F-centric model in driving uptake of products? Ultimately, this question will only be answered fully in time, when the immediate infection crisis is passed, and commercial activities settle into the new steady state. Nonetheless, one year on from the onset of the pandemic, IQVIA’s ChannelDynamics® promotional audit data provides some early clues as to the direction of change.

We assessed the performance of the three key interactive detailing channels - F2F, telephone, and live e-detailing (carried out via a virtual conferencing tool such a Zoom, Teams, etc) - based on two indicators of impact:

- Average detail duration - an important indicator as the time a rep spends with an HCP is critical to conveying the necessary information to ensure the HCP is comfortable prescribing the product, as well as to building the relationship and trust between them

- Reported intent to prescribe - the HCPs future intended level of prescribing after the interaction; while this metric is not as robust as tracking actual Rx levels resulting from a particular contact, it serves as a good proxy

When looking at average call duration for 2020 we found that in all of the countries we included in the analysis live e-details were longer on average than F2F details (Figure 2a). One likely reason for this is that e-details are able to be scheduled for a time that is most convenient for the physician meaning they have more time to dedicate to it. What is more, in all countries except Spain, the average duration of a live e-detail increased in 2020 relative to 2019 (Figure 2b). This is likely due to a number of reasons: physicians became more used to them as the whole world embraced virtual communication channels, some physicians not directly involved in treating COVID infections may have had more time due to decreased patient visits, or the fact that live e-details were replacing contacts that would normally being held F2F, rather than being supplementary to F2F contacts.

We also discovered that live e-details matched or outperformed F2F details in terms of impact on intent to prescribe in all countries except Spain and Italy (Figure 3a). This exception is most probably due to the fact that the promotional model in these countries is culturally very traditional and dominated by F2F, far more focused on relationships and high-touch, personal interactions between reps and physicians.

The fact that these remote virtual interactions have the potential to be as impactful, if not more so, than F2F interactions in terms of driving prescriptions is hugely encouraging to the industry. Not only that, but 2020 also saw the impact of live e-details on reported prescribing behaviour increase significantly compared to 2019 (Figure 3b), suggesting that as these types of interaction become more commonplace and companies become better at delivering high quality virtual experiences to their customers, their effectiveness at driving uptake will continue to improve.

The past year has definitively changed HCP behaviours and expectations and, with healthcare systems stretched to the limit as they work to recover from the pandemic, widespread use of digital is here to stay. It is vital that the industry embrace this direction of change and continue to commit to building a new commercial model in which remote, interactive contacts are included as core channels, providing engagement impact that is as effective, or more effective than the model it replaces, and is fit for purpose in the post pandemic environment.