-

Americas

-

Asia & Oceania

-

A-I

J-Z

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more -

Middle East & Africa

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more

Regions

-

Americas

-

Asia & Oceania

-

Europe

-

Middle East & Africa

-

Americas

-

Asia & Oceania

-

Europe

Europe

- Adriatic

- Belgium

- Bulgaria

- Czech Republic

- Deutschland

- España

- France

- Greece

- Hungary

- Ireland

- Israel

- Italia

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more -

Middle East & Africa

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more

SOLUTIONS

-

Research & Development

-

Real World Evidence

-

Commercialization

-

Safety & Regulatory Compliance

-

Technologies

LIFE SCIENCE SEGMENTS

HEALTHCARE SEGMENTS

- Information Partner Services

- Financial Institutions

- Global Health

- Government

- Patient Associations

- Payers

- Providers

THERAPEUTIC AREAS

- Cardiovascular

- Cell and Gene Therapy

- Central Nervous System

- GI & Hepatology

- Infectious Diseases and Vaccines

- Oncology

- Pediatrics

- Rare Diseases

- View All

Impacting People's Lives

"We strive to help improve outcomes and create a healthier, more sustainable world for people everywhere.

LEARN MORE

Harness the power to transform clinical development

Reimagine clinical development by intelligently connecting data, technology, and analytics to optimize your trials. The result? Faster decision making and reduced risk so you can deliver life-changing therapies faster.

Research & Development OverviewResearch & Development Quick Links

Real World Evidence. Real Confidence. Real Results.

Generate and disseminate evidence that answers crucial clinical, regulatory and commercial questions, enabling you to drive smarter decisions and meet your stakeholder needs with confidence.

REAL WORLD EVIDENCE OVERVIEWReal World Evidence Quick Links

See markets more clearly. Opportunities more often.

Elevate commercial models with precision and speed using AI-driven analytics and technology that illuminate hidden insights in data.

COMMERCIALIZATION OVERVIEWCommercialization Quick Links

Service driven. Tech-enabled. Integrated compliance.

Orchestrate your success across the complete compliance lifecycle with best-in-class services and solutions for safety, regulatory, quality and medical information.

COMPLIANCE OVERVIEWSafety & Regulatory Compliance Quick Links

Intelligence that transforms life sciences end-to-end.

When your destination is a healthier world, making intelligent connections between data, technology, and services is your roadmap.

TECHNOLOGIES OVERVIEWTechnology Quick Links

CLINICAL PRODUCTS

COMMERCIAL PRODUCTS

COMPLIANCE, SAFETY, REG PRODUCTS

BLOGS, WHITE PAPERS & CASE STUDIES

Explore our library of insights, thought leadership, and the latest topics & trends in healthcare.

DISCOVER INSIGHTSTHE IQVIA INSTITUTE

An in-depth exploration of the global healthcare ecosystem with timely research, insightful analysis, and scientific expertise.

SEE LATEST REPORTSFEATURED INNOVATIONS

-

IQVIA Connected Intelligence™

-

IQVIA Healthcare-grade AI™

-

IQVIA AI Assistant

-

Human Data Science Cloud

-

IQVIA Innovation Hub

-

Decentralized Trials

-

Patient Experience Solutions with Apple devices

WHO WE ARE

- Our Story

- Our Impact

- Commitment to Global Health

- Code of Conduct

- Sustainability

- Privacy

- Executive Team

NEWS & RESOURCES

Unlock your potential to drive healthcare forward

By making intelligent connections between your needs, our capabilities, and the healthcare ecosystem, we can help you be more agile, accelerate results, and improve patient outcomes.

LEARN MORE

IQVIA AI is Healthcare-grade AI

Building on a rich history of developing AI for healthcare, IQVIA AI connects the right data, technology, and expertise to address the unique needs of healthcare. It's what we call Healthcare-grade AI.

LEARN MORE

Meet the IQVIA AI Assistant

Your new expert analyst is here. Be at the forefront of data-driven decision-making with a new generative AI tool that enables you to interact with our products and solutions like never before. Get results you can trust, faster.

LEARN MORE

Your healthcare data deserves more than just a cloud.

The IQVIA Human Data Science Cloud is our unique capability designed to enable healthcare-grade analytics, tools, and data management solutions to deliver fit-for-purpose global data at scale.

LEARN MORE

Innovations make an impact when bold ideas meet powerful partnerships

The IQVIA Innovation Hub connects start-ups with the extensive IQVIA network of assets, resources, clients, and partners. Together, we can help lead the future of healthcare with the extensive IQVIA network of assets, resources, clients, and partners.

LEARN MORE

Proven, faster DCT solutions

IQVIA Decentralized Trials deliver purpose-built clinical services and technologies that engage the right patients wherever they are. Our hybrid and fully virtual solutions have been used more than any others.

LEARN MORE

IQVIA Patient Experience Solutions with Apple devices

Empowering patients to personalize their healthcare and connecting them to caregivers has the potential to change the care delivery paradigm.

LEARN MOREIQVIA Careers

Featured Careers

Stay Connected

WE'RE HIRING

"At IQVIA your potential has no limits. We thrive on bold ideas and fearless innovation. Join us in reimagining what’s possible.

VIEW ROLES- Blogs

- Five top mergers and acquisitions in spine in 2018

1. Medtronic acquires Mazor Robotics

After beginning its investment in Mazor Robotics two years ago, spine market leader Medtronic completed its acquisition of the spine and brain robotics company in December 2018 for $1.7 billion. Robotic surgery remains one of the hottest areas in medtech, and the acquisition of Mazor aligns with Medtronic’s belief that robotic-assisted procedures are the future of spine surgery.

The significant momentum and high level of surgeon interest in robotics can be attributed to the fact that these systems offer significant benefits to both patients and surgeons:

2. Stryker acquires K2M

Stryker’s share of the spinal implant market has been declining in recent years, with spine representing the slowest growing component of the company’s portfolio. It is with that backdrop that Stryker agreed to purchase spine-focused K2M for $1.4 billion, with the deal closing in early November. K2M has been growing in the double digits and is a noted leader in minimally invasive spine solutions, with strength in complex spine applications. With minimal product and account overlap, Stryker hopes that the acquisition of K2M can be a growth driver for the company and reverse its fortunes in the spine space.

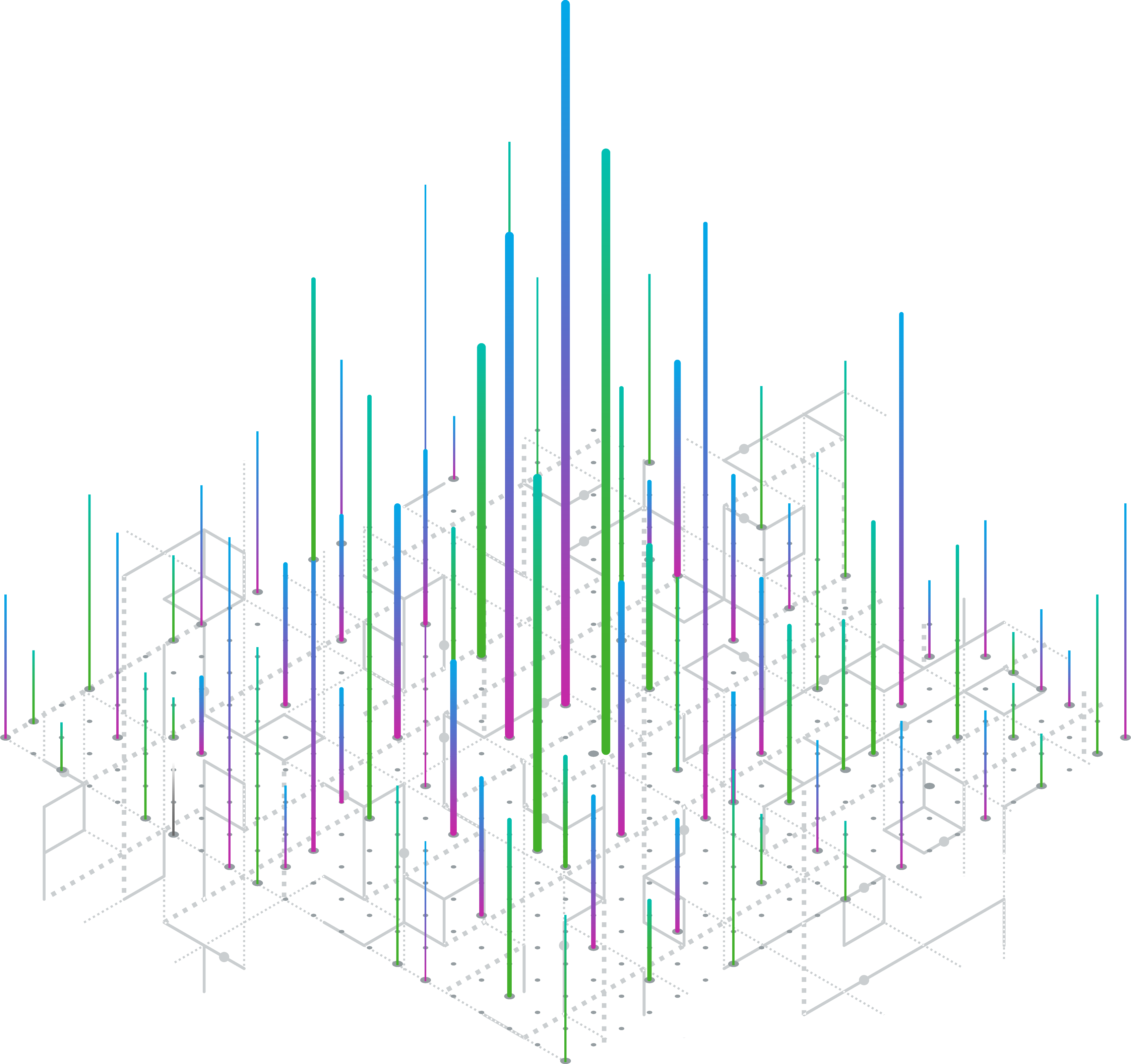

Leaders in the US spinal implant market (hospital setting)

Source: Medical Device & Supply Audit

3. RTI Surgical to acquire Paradigm Spine

To further establish its presence in the spine market, RTI Surgical announced in early November its intent to acquire Paradigm Spine and its coflex interlaminar stabilization technology for $150 million, with an additional $150 million linked to unspecified future milestones. The transaction is expected to close in the first quarter of 2019.

Paradigm Spine’s coflex is a motion-preserving implant for the treatment of patients with moderate to severe spinal stenosis. The device obviates the need for fusion surgery and can be implanted in a minimally invasive procedure in an outpatient setting. Supported by a coverage policy recommendation from the North American Spine Society, coflex has received a slew of positive private payor coverage decisions in the past 12 months.

4. Orthofix acquires Spinal Kinetics

At the end of April, Orthofix completed its $105 million acquisition of privately held Spinal Kinetics and its M6 line of artificial discs. Under the terms of the agreement, Orthofix paid $45 million in cash at closing and will pay up to $60 million in contingent milestone payments related to FDA approval and the achievement of trailing twelve-month sales targets of $30 million and $50 million.

The M6 cervical and lumbar artificial discs help fill a strategic gap in Orthofix’s spinal products portfolio, giving the company access to the fast-growing artificial disc market and signaling the company’s commitment to increasing its footprint in the highly competitive spine market.

The M6 artificial discs are currently approved in Europe and other countries outside the US, with more than 54,000 implants placed since the products' 2006 launch. While the products are not yet available for commercial distribution in the US, Spinal Kinetics has made a premarket approval (PMA) submission to the FDA seeking approval for the M6-C cervical disc to treat single-level cervical degenerative disc disease.

5. Stryker acquires Invuity

In October, Stryker finalized its acquisition of Invuity, an advanced illumination surgical device company, for $190 million. While not a traditional spinal implant company, Invuity provides single-use lighted instruments that use the company’s patented advanced photonics technology to enhance visualization in minimally invasive procedures across multiple therapeutic areas including spine, orthopedics, general surgery, and women's health.

Other acquisitions in the spine space in 2018 include: